TMO Stock Recent News

TMO LATEST HEADLINES

Market fear creates hesitation, but history shows scary headlines often mark great buying opportunities. I assess risk, not just wait for perfect timing. My strategy to rotate from growth to value has helped me outperform. I bought quality dividend growers when panic set in, based on logic, not luck. I highlight two compelling stocks: one a powerful long-term grower in healthcare, the other a higher-yielding pick tied to industrial strength and income stability.

Get a deeper insight into the potential performance of Thermo Fisher (TMO) for the quarter ended March 2025 by going beyond Wall Street's top -and-bottom-line estimates and examining the estimates for some of its key metrics.

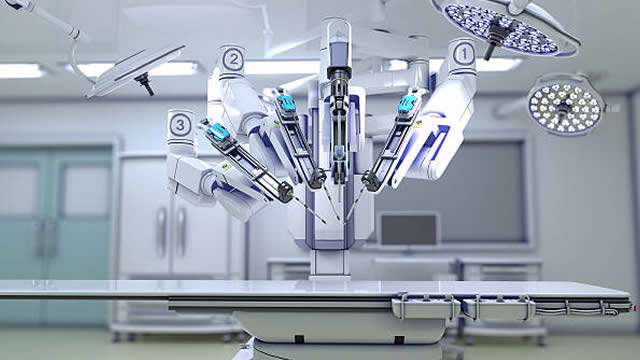

CARLSBAD, Calif.--(BUSINESS WIRE)--Thermo Fisher Scientific Inc., the world leader in serving science, today announced the grand opening of its Advanced Therapies Collaboration Center (ATxCC) in Carlsbad, Calif. This advanced facility is designed to accelerate the development and commercialization of cell therapies, specifically by supporting biotech, biopharma and translational customers developing cell-based immunotherapies. Through this new center, cell therapy developers can leverage Thermo.

Thermo Fisher (TMO) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Strength in Analytical Instruments and Specialty Diagnostics segments is likely to have driven Thermo Fisher's first-quarter 2025 performance.

Thermo Fisher Scientific shows strong fundamentals, consistent earnings growth, and solid financial health, making it a viable long-term investment. TMO's recent product expansion, including the breakthrough Krios 5 Cryo-TEM technology, is expected to drive future growth and support earnings. Valuation metrics indicate TMO is currently undervalued.

WALTHAM, Mass.--(BUSINESS WIRE)--Thermo Fisher Scientific Inc., the world leader in serving science, today announced the 5L DynaDrive Single-Use Bioreactor (S.U.B.), designed to meet the evolving needs of modern bioprocessing. The 5L DynaDrive expands the company's robust portfolio of bioreactors, offering seamless scalability from 1 to 5,000 liters and accelerating bench-scale process development, while facilitating the cost-effective transition from bench to commercialization with consistent.

Thermo Fisher (TMO) was a big mover last session on higher-than-average trading volume. The latest trend in earnings estimate revisions might not help the stock continue moving higher in the near term.

TMO launches the Krios 5 Cryo-TEM, boosting productivity and performance with enhanced automation.

TMO continues to hold on to investors' attention due to its value-added acquisitions and trusted end-market channels.