TRGP Stock Recent News

TRGP LATEST HEADLINES

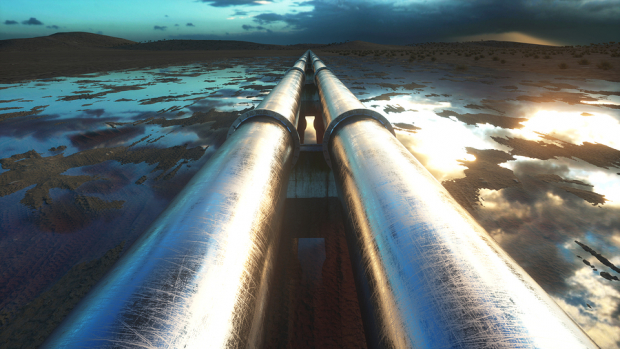

TRGP launches open season for its Forza Pipeline, aiming to boost Delaware Basin gas connectivity to Texas markets by mid-2028.

HOUSTON, Sept. 02, 2025 (GLOBE NEWSWIRE) -- Targa Resources Corp. (NYSE: TRGP) (“Targa” or the “Company”) announced today the launch of a non-binding open season for its proposed Forza Pipeline Project (“Forza Project”), a new interstate natural gas pipeline that will support increasing natural gas production in the Delaware Basin in Southeast New Mexico.

Targa Resources is well positioned in the Permian Basin, driving strong volume and cash flow growth through aggressive capital investment and infrastructure expansion. Despite a lower dividend yield than peers, Targa's buyback program and future dividend growth potential make it attractive for long-term investors. The company maintains a solid balance sheet, manageable leverage, and benefits from tax changes, supporting ongoing growth projects without financial strain.

TRGP benefits from strong global LPG demand, fee-based revenues, tax advantages and Permian scale, but faces risks from overbuild, execution and competition.

TRGP expects full-year 2025 adjusted EBITDA of $4.65-$4.85 billion and net growth capital expenditures of $3 billion.

Targa Resources Corp. (NYSE:TRGP ) Q2 2025 Earnings Conference Call August 7, 2025 11:00 AM ET Company Participants Benjamin Branstetter - Corporate Participant D. Scott Pryor - President of Logistics & Transportation Jennifer R.

Get a deeper insight into the potential performance of Targa Resources (TRGP) for the quarter ended June 2025 by going beyond Wall Street's top-and-bottom-line estimates and examining the estimates for some of its key metrics.

HOUSTON, July 10, 2025 (GLOBE NEWSWIRE) -- Targa Resources Corp. (NYSE: TRGP) ("Targa" or the "Company") announced today that its board of directors has declared a quarterly cash dividend of $1.00 per common share, or $4.00 per common share on an annualized basis, for the second quarter of 2025. This cash dividend will be paid August 15, 2025 on all outstanding common shares to holders of record as of the close of business on July 31, 2025.

Dividends are one of the best benefits to being a shareholder, but finding a great dividend stock is no easy task. Does Targa Resources, Inc. (TRGP) have what it takes?

Targa offers strong EBITDA growth, Permian strength and shareholder returns, but faces debt, capex strain, trade risks and rising midstream competition.