TXN Stock Recent News

TXN LATEST HEADLINES

Texas Instruments Inc (NASDAQ:TXN) will report second-quarter earnings after the close tomorrow, July 22, in which analysts expect earnings of $1.35 per share and a 13.8% year-over-year increase in revenue to $4.35 billion.

The Investment Committee discuss their top picks in the semiconductor sector.

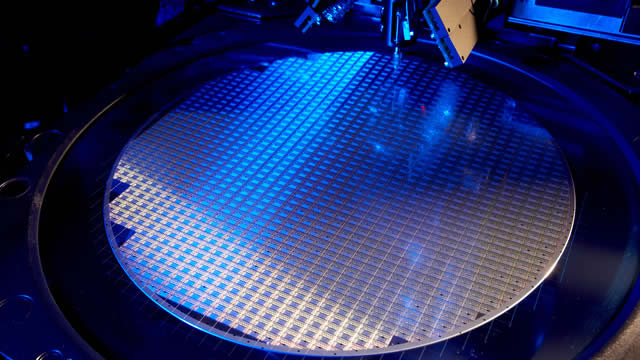

DALLAS , July 17, 2025 /PRNewswire/ -- The board of directors of Texas Instruments Incorporated (Nasdaq: TXN) today declared a quarterly cash dividend of $1.36 per share of common stock, payable August 12, 2025, to stockholders of record on July 31, 2025. About Texas Instruments Texas Instruments Incorporated (Nasdaq: TXN) is a global semiconductor company that designs, manufactures and sells analog and embedded processing chips for markets such as industrial, automotive, personal electronics, enterprise systems and communications equipment.

Texas Instruments' Q2 performance is likely to reflect benefits from recovery across the industrial and automotive end markets.

Get a deeper insight into the potential performance of Texas Instruments (TXN) for the quarter ended June 2025 by going beyond Wall Street's top-and-bottom-line estimates and examining the estimates for some of its key metrics.

Live Updates Live Coverage Updates appear automatically as they are published. Earnings Conference Call Highlights 11:58 am Market Backdrop: AI as key growth driver for logic (capacity on leading nodes) and memory (HBM/DDR5 transitions). China revenue moderating to backlog proportion (~25%+). Customers adding ~30% EUV capacity YoY. Increasing EUV layers in advanced DRAM for process simplification. Uncertainties: Macro/geopolitical developments (e.g., tariffs) causing customer caution; Direct tariff impact limited (working with suppliers/customers); Indirect via GDP/demand harder to quantify. Some customers facing specific challenges affecting capex timing. Backlog adjustment (€1.4B) due to 2024 China controls. Technology Progress: Low-NA EUV: Strong momentum; NXE:3800E enabling more EUV use in DRAM. High-NA EUV: First EXE:5200B shipped/installed (175+ wafers/hour, ~60% productivity gain over EXE:5000); Maturing for HVM; Enables single-exposure vs. multi-patterning, reducing costs and

Investors interested in Semiconductor - General stocks are likely familiar with STMicroelectronics (STM) and Texas Instruments (TXN). But which of these two stocks presents investors with the better value opportunity right now?

Texas Instruments is in a good spot to benefit as the industrial sector recovers and its U.S. footprint lessens tariff risk, per TD Cowen analysts.

The chip maker sells the basic building-block chips that go into products in nearly every sector of the economy, from autos and industrials to consumer electronics.

Zacks.com users have recently been watching Texas Instruments (TXN) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.