UGI Stock Recent News

UGI LATEST HEADLINES

INTU, FOX, QFIN, UGI and INGR stand out given their rising dividends, strong earnings growth and resilient fundamentals.

The energy play remains attractive even after a 55% share-price climb over the past year.

Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

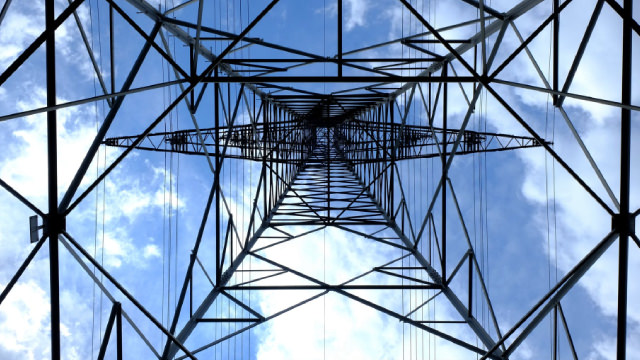

Investors looking for stocks in the Utility - Gas Distribution sector might want to consider either UGI (UGI) or Atmos Energy (ATO). But which of these two stocks is more attractive to value investors?

UGI (UGI) reported earnings 30 days ago. What's next for the stock?

UGI (UGI) is at a 52-week high, but can investors hope for more gains in the future? We take a look at the company's fundamentals for clues.

NTES, FOX, QFIN and UGI stand out as strong dividend growth stocks amid market volatility and economic uncertainty.

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

VALLEY FORGE, Pa.--(BUSINESS WIRE)--UGI Corporation (NYSE: UGI) announced today that its subsidiaries, AmeriGas Partners, L.P. (“AmeriGas Partners”) and AmeriGas Finance Corp., (together with AmeriGas Partners, the “Offerors”) have received, as of 5:00 p.m., New York City time, on May 27, 2025 (the “Expiration Time”), tenders from holders of $553,275,000 in aggregate principal amount (excluding tenders through guaranteed delivery procedures), representing approximately 83.3%, of the Offerors' 5.

VALLEY FORGE, Pa.--(BUSINESS WIRE)--UGI Corporation (NYSE: UGI) announced today that its subsidiaries, AmeriGas Partners, L.P. (“AmeriGas Partners”) and AmeriGas Finance Corp. (together with AmeriGas Partners, the “Issuers”) priced their offering of $550,000,000 in aggregate principal amount of 9.500% senior notes due 2030 (the “Notes”) in an offering to persons reasonably believed to be qualified institutional buyers pursuant to Rule 144A under the Securities Act of 1933, as amended (the “Secu.