UI Stock Recent News

UI LATEST HEADLINES

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

Ubiquiti, Flotek and Goldman Sachs stand out as top Zacks picks, each posting major gains after key rating upgrades.

The heavy selling pressure might have exhausted for Ubiquiti (UI) as it is technically in oversold territory now. In addition to this technical measure, strong agreement among Wall Street analysts in revising earnings estimates higher indicates that the stock is ripe for a trend reversal.

Tech giants like INTU, APH, AVGO, TWLO and UI surged over 11% in May, powering markets past the "Sell in May" adage with standout gains.

UI reports top-line growth year over year in fiscal Q3, backed by healthy demand in the Enterprise Technology segment products across several regions.

Ubiquiti Inc. (UI) came out with quarterly earnings of $3 per share, beating the Zacks Consensus Estimate of $1.86 per share. This compares to earnings of $1.28 per share a year ago.

NEW YORK--(BUSINESS WIRE)--Ubiquiti Inc. (NYSE: UI) ("Ubiquiti" or the "Company") today announced its financial results for the third quarter ended March 31, 2025. Third Quarter Fiscal 2025 Financial Summary Revenues of $664.2 million GAAP diluted EPS of $2.98 Non-GAAP diluted EPS of $3.00 Additional Financial Highlight The Company's Board of Directors declared a $0.60 per share cash dividend payable on May 27, 2025 to shareholders of record at the close of business on May 19, 2025. Financial H.

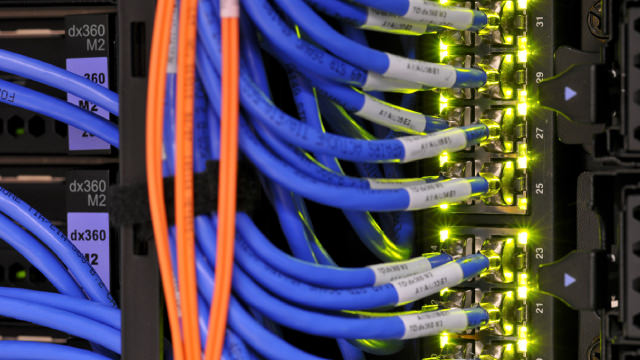

With solid demand for advanced networking architecture for increased broadband usage, the Zacks Wireless Equipment industry is likely to witness healthy growth. ERIC, UI and IDCC are set to thrive despite the near-term challenges.

Investors can boost returns by adding top-ranked liquid stocks such as Mattel, CommScope, Ubiquiti and Willdan to their portfolios.

With healthy fundamentals and solid price appreciation, UI appears to be an enticing investment option in the volatile market.