UNH Stock Recent News

UNH LATEST HEADLINES

UNH surges 8.6% as it projects stable Medicare Advantage star ratings, easing investor worries over performance.

Trying to time the market with falling knives like UnitedHealth—which it was in the spring and summer—was extremely risky, so I chose to wait for momentum to return. Valuation metrics are attractive, with forward P/E and P/S ratios far below historical averages, making UNH a compelling value due to rock-solid fundamentals. Yesterday's reiteration of the EPS outlook by the management is crucial, as it underscores that the headwinds are temporary and their adverse effects are unlikely to persist for long.

Many retail investors fear selloffs. But if you know where to look, pullbacks can be your best friend. If you look at any stock that pulled off a significant recovery from its trough, your natural reaction is likely “I wish I bought that dip!” However, it’s understandable why many refuse to buy the dip. Many stocks that do go down turn into falling knives. When it comes to well-established dividend payers, the equation is in your favor. Instead of praying for a recovery, you get paid to wait, and that stream of dividends quietly compounds while the market decides whether it still wants to sit on the sidelines. Chances are, the market will decide to pounce, especially since the economy is sitting at a crossroads. Interest rates are expected to be cut soon, making dividend yields more attractive. Plus, undervalued dividend stocks with established underlying businesses are very likely to rebound in the long run. This gives investors both upside and dividends. Here are th

UnitedHealth Group (NYSE: UNH) jumped 8% on September 9, 2025, after the company said it is on track to meet its Medicare Advantage enrollment goals. The update eased investor concerns that the insurer could miss these critical targets amid ongoing operational challenges.

David Tepper's bold second-quarter buying spree in UnitedHealth Group Inc. UNH is already paying off. The billionaire hedge fund manager's Appaloosa Management increased its stake in the health insurance giant by a staggering 1,300% last quarter, turning a once-minor position into his fund's second-largest holding.

Investors are increasingly scrutinizing company earnings as market volatility continues to shape investment strategies. Amid this climate, key figures like Jim Cramer are vocal about their preferences, emphasizing growth potential and stability in their stock picks.

Warren Buffett's Berkshire Hathaway stake in UnitedHealth reaffirms my strong buy rating, seeing long-term value despite recent volatility. UNH faces headwinds: earnings misses, revised guidance, and higher medical costs, but maintains strong revenue growth in key segments. The 2.76% dividend yield, robust cash flows, and a solid balance sheet make UNH attractive for dividend and long-term investors.

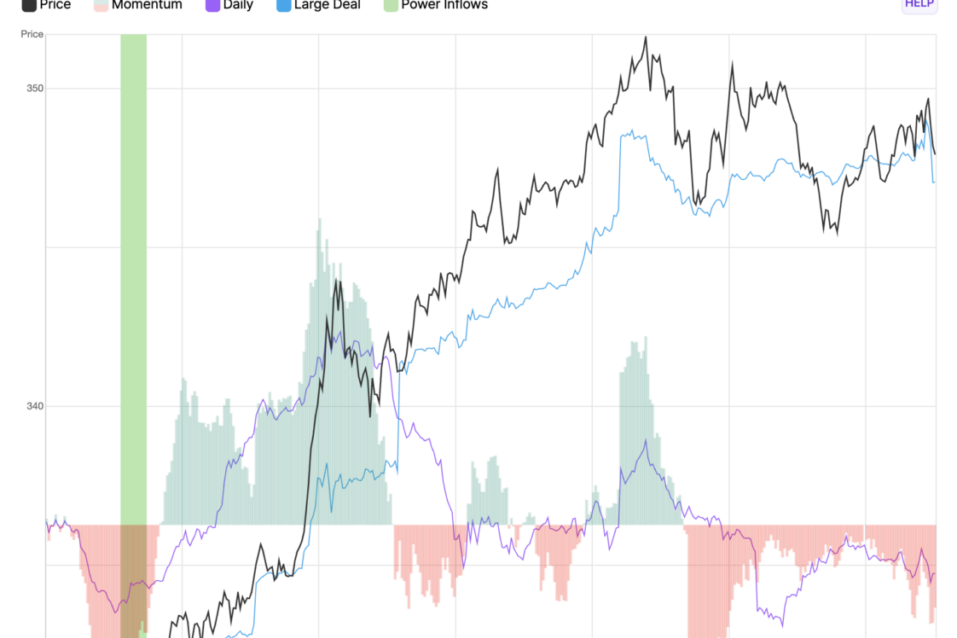

UNH rises over 20 points after alert at 10:12 am EDT

The final trades of the day with CNBC's Melissa Lee and the Fast Money traders.

Major U.S. equities indexes advanced to record closing highs after the Bureau of Labor Statistics announced a significant downward revision in job growth between March 2024 and March 2025.