V Stock Recent News

V LATEST HEADLINES

Visa posts double-digit Q3 gains in cross-border volumes and earnings, but shares slide 5.5% amid rising costs and regulatory risks.

Warren Buffett has a strong case for being the most well-known name in the investing world. He has spent six decades leading Berkshire Hathaway to become one of the world's premier companies and has made many investors rich along the way.

Visa remains a buy due to its consistent double-digit earnings growth, high returns on capital, and resilient business model. Recent Q3 results confirm Visa's compounding engine status, with 14% revenue and 23% EPS growth, plus strong performance in value-added services. Stablecoin risks are overblown; Visa's entrenched network, consumer habits, and ongoing innovation make disruption unlikely in core payments.

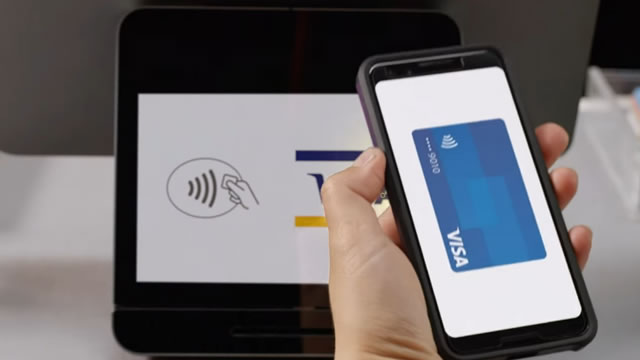

The threat of disruption to the payment processing industry has investors wary of Visa (V 0.81%) stock.

If any investor has stood the test of time, it's Warren Buffett, and with good reason.

So far this year, Visa Inc. (NYSE: V) has unveiled a scam disruption initiative, adoption of its “Tap to Phone” technology has soared, it unveiled its vision for artificial intelligence (AI) in commerce, and it expanded of its stablecoin settlement capabilities.