VRT Stock Recent News

VRT LATEST HEADLINES

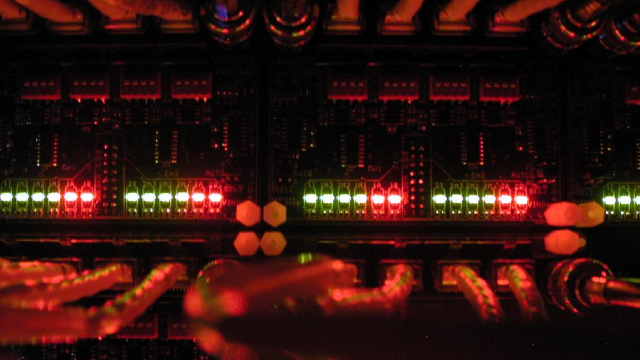

Vertiv gains ground over Generac Holdings, driven by soaring AI demand, strong orders, and innovative cooling technology for next-generation data centers.

Vertiv (VRT) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Vertiv's AI-focused alliances drive growth across power, cooling and infrastructure in high-density deployments.

COLUMBUS, Ohio , July 16, 2025 /PRNewswire/ -- Vertiv Holdings Co. (NYSE: VRT), a global leader in critical digital infrastructure, today announced it will report its second quarter 2025 results before market open on Wednesday, July 30, 2025. The press release will contain a link to the presentation materials providing a second quarter 2025 update, which will be available on Vertiv's website at investors.vertiv.com.

Vertiv Holdings Co. (VRT) concluded the recent trading session at $127.37, signifying a +2.12% move from its prior day's close.

I reiterate my Buy rating on Vertiv Holdings Co with a $127 price target, despite recent Amazon news and a short-term share price dip. Amazon's in-house liquid cooling announcement triggered a selloff despite the news not being new. I do not expect this to materially change Vertiv's growth story. Vertiv remains well-positioned for AI infrastructure growth across other hyperscalers, supported by strong demand for compute capacity for AI applications.

Vertiv stock rose Friday after plunging Thursday on a report that AWS had developed a possible competing liquid-cooling system for data centers.

VRT and SMCI race to lead AI-driven liquid cooling, but diverging earnings paths may reveal the stronger play.

Shares of Vertiv (VRT -4.78%), which makes infrastructure for cooling and power systems for data centers, were heading lower today on reports that Amazon could be challenging the company in cooling technology.

Vrt stock took a hit on the markets today, with its stock dropping more than 11% after Amazon Web Services rolled out its own custom cooling tech for high-performance AI servers. The news caught investors off guard and sparked fresh concerns about Vertiv's position in a fast-evolving data center landscape.