WEC Stock Recent News

WEC LATEST HEADLINES

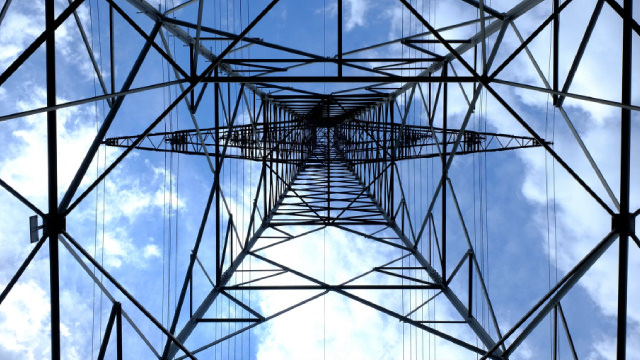

WEC Energy Group offers predictable earnings, a 3.3% yield, and 21 years of dividend growth, making it ideal for risk-averse, income-focused investors. WEC stands out for its strong balance sheet, above-average returns, and rare free cash flow generation among utilities, supporting long-term growth. Major capital investments, data center demand, and robust capex plans position WEC for continued revenue and earnings growth above industry averages.

MILWAUKEE , Aug. 7, 2025 /PRNewswire/ -- WEC Energy Group (NYSE: WEC) today released its 2024 Corporate Responsibility Report. The report outlines the progress made by WEC Energy Group's family of companies on major projects and the company's mission to deliver affordable, reliable and clean energy across the Midwest.

WEC's second-quarter 2025 earnings and revenues increase year over year. Total operating expenses also increase during the period.

WEC Energy Group, Inc. (NYSE:WEC ) Q2 2025 Earnings Conference Call July 30, 2025 2:00 PM ET Company Participants Scott J. Lauber - President, CEO & Director Xia Liu - Executive VP & CFO Conference Call Participants Andrew Marc Weisel - Scotiabank Global Banking and Markets, Research Division Brian J.

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

WEC Energy Group (WEC) came out with quarterly earnings of $0.76 per share, beating the Zacks Consensus Estimate of $0.71 per share. This compares to earnings of $0.67 per share a year ago.

WEC Energy Group reported a 16% increase in second-quarter profit on Wednesday, as the utility company benefited from higher sales in its residential segment.

MILWAUKEE , July 30, 2025 /PRNewswire/ -- WEC Energy Group (NYSE: WEC) today reported net income of $245.4 million, or 76 cents per share, for the second quarter of 2025 — up from $211.3 million, or 67 cents per share, in last year's second quarter. For the first six months of 2025, the company recorded net income of $969.6 million, or $3.02 per share — up from $833.6 million, or $2.64 per share, in the corresponding period a year ago.

Get a deeper insight into the potential performance of WEC Energy (WEC) for the quarter ended June 2025 by going beyond Wall Street's top-and-bottom-line estimates and examining the estimates for some of its key metrics.

MILWAUKEE , July 23, 2025 /PRNewswire/ -- WEC Energy Group Inc. (NYSE: WEC) will issue its 2025 second-quarter earnings news release before the stock market opens Wednesday, July 30. A conference call for investors and security analysts is scheduled for the same day at 1 p.m.