WFC Stock Recent News

WFC LATEST HEADLINES

Dividends are one of the best benefits to being a shareholder, but finding a great dividend stock is no easy task. Does Wells Fargo (WFC) have what it takes?

WFC outlines its post asset cap growth strategy, targeting efficiency gains, stable NII, and expansion in lending and wealth management.

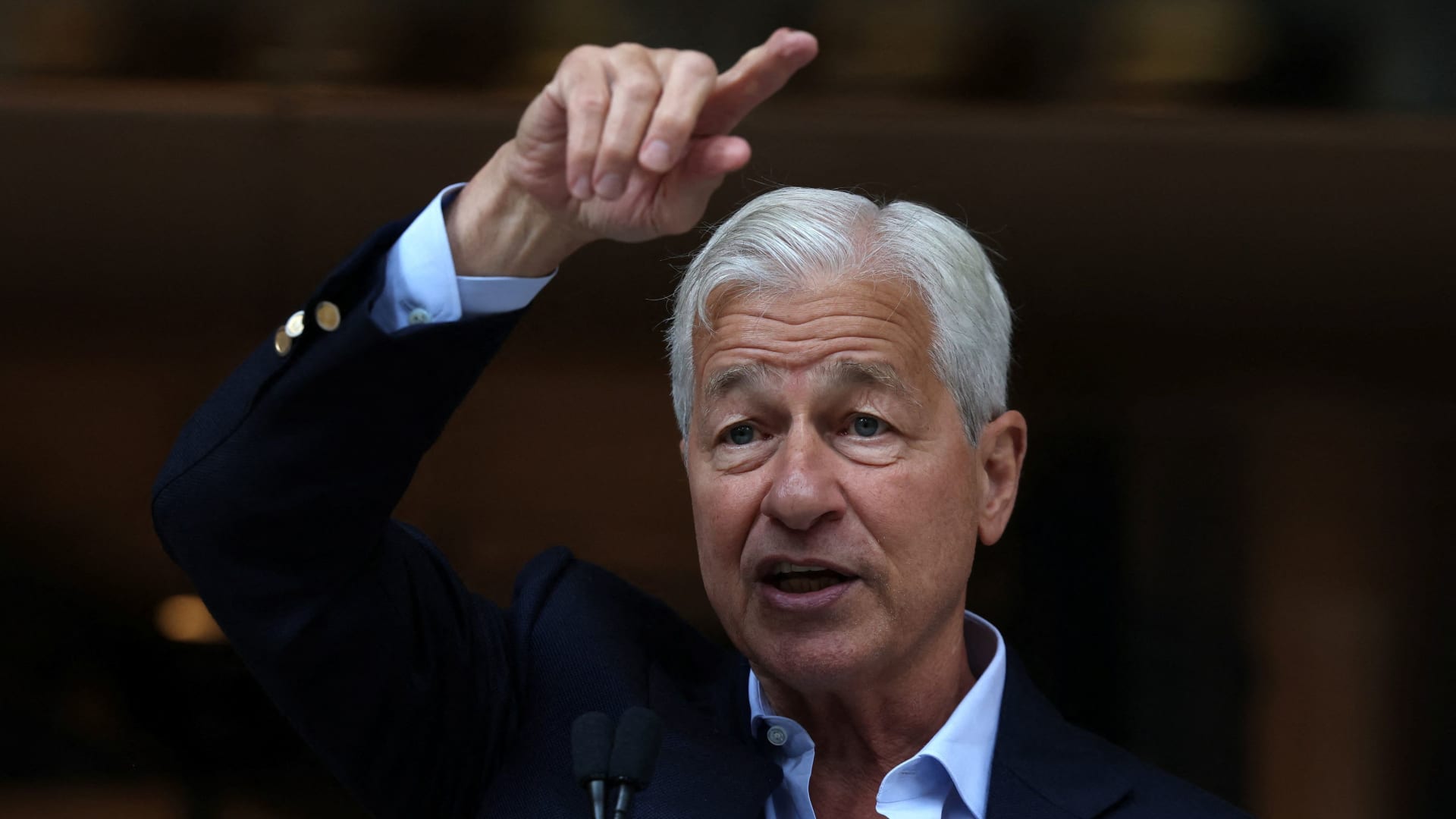

Amid economic uncertainty and a Bureau of Labor Statistics preliminary report revising down job numbers, CEOs weighed in this week on CNBC. Ranging from JPMorgan Chase CEO Jamie Dimon to PNC Financial Services CEO Bill Demchak, executives are starting to issue varying degrees of warning about slowdown.

Wells Fargo CEO Charlie Scharf said he "absolutely" supports the Federal Reserve's independence, but that President Donald Trump is free to express his beliefs on how the central bank should set monetary policy.

Wells Fargo CEO Charlie Scharf said he supports the Federal Reserve's independence and believes the central bank is still independent. Scharf added that he believes President Donald Trump is entitled to be vocal about his thoughts on interest rates.

Wells Fargo CEO Charles Scharf said Wednesday that while corporations and higher-income consumers are thriving, lower income Americans are struggling to stay afloat.

Wells Fargo CEO Charles Scharf said Wednesday that while corporations and higher-income consumers are thriving, lower income Americans are struggling to stay afloat. The bank's data shows that while "companies are in really great shape" and spending among all income levels has been steady, there are signs of stress among lower earners, Scharf said in an interview on CNBC's Squawk Box.

Wells Fargo CEO Charles Scharf joins 'Squawk Box' to discuss the state of the economy, state of the consumer, consumer spending, impact of AI, state of banking, Fed independence, latest market trends, impact of tariffs, and more.

In the latest trading session, Wells Fargo (WFC) closed at $80.76, marking a +2.05% move from the previous day.

Senators Warren and Sanders urge JPMorgan, Citigroup, WFC, MS and peers to prioritize lending over shareholder payouts.