X Stock Recent News

X LATEST HEADLINES

David Burritt defended the safety record of the company the day after a deadly blast at one of its Pennsylvania plants killed two people and injured 10.

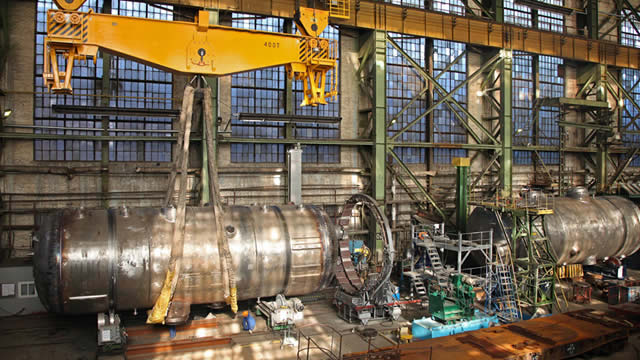

PITTSBURGH, Aug. 12, 2025 (GLOBE NEWSWIRE) -- On August 11, 2025, an explosion occurred at the U.S. Steel Clairton Coke Works Plant in the Mon Valley of Western Pennsylvania.1 The explosion has left at least one person dead and others either injured or unaccounted for. Allegheny County officials have advised nearby residents to remain inside.

A United States Steel Corp. plant in Pennsylvania that experienced an explosion that killed at least two people has a history of accidents and violations over the past 15 years. The incident comes less than two months after Nippon Steel closed on the $14 billion dollar deal to acquire US Steel.

An explosion occurred at a steel plant near Pittsburgh, Pennsylvania. Several people have been injured and at least one person has died, police said.

Get Forbes Breaking News Text Alerts: We're launching text message alerts so you'll always know the biggest stories shaping the day's headlines. Text “Alerts” to (201) 335-0739 or sign up here: joinsubtext.com/forbes.

An explosion rocked the U.S. Steel Clairton Coke Works facility near Pittsburgh Monday, leaving people trapped beneath the rubble, officials said.

Gov. Josh Shapiro said state officials were responding to Clairton Coke Works in Clairton, Pa., roughly 15 miles southeast of Pittsburgh.

Global rating agency S&P downgraded Nippon Steel to 'BBB' from 'BBB+' with a 'negative' outlook on Thursday, citing an increasing financial strain following the Japanese steelmaker's acquisition of U.S. Steel last month.

Japan's Nippon Steel said on Wednesday it would raise 800 billion yen ($5.6 billion) through two subordinated loans to partially fund its recent $14.9 billion acquisition of U.S. Steel and refinance previous loans.

U.S. Steel's amended charter gives Trump sweeping powers over major business decisions while he is in office. The "golden share" will then be held by the Treasury and Commerce Departments after Trump's term is over, according to an SEC filing.