XEL Stock Recent News

XEL LATEST HEADLINES

XEL's first-quarter earnings are lower than expected. The company adds electric and natural gas customers to its existing base and gains from higher demand.

While the top- and bottom-line numbers for Xcel (XEL) give a sense of how the business performed in the quarter ended March 2025, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

Xcel Energy (XEL) came out with quarterly earnings of $0.84 per share, missing the Zacks Consensus Estimate of $0.93 per share. This compares to earnings of $0.88 per share a year ago.

U.S.-based utility Xcel Energy missed Wall Street estimates for first-quarter profit on Thursday, hurt by higher operating and interest expenses.

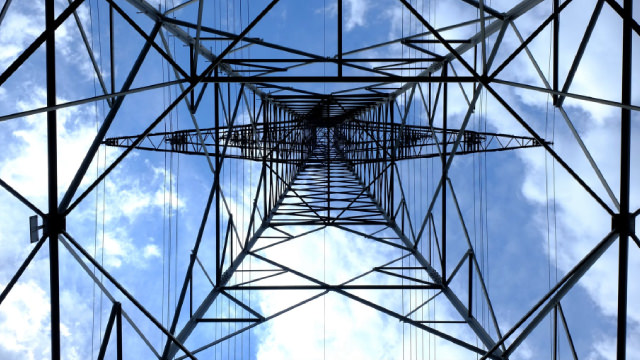

MINNEAPOLIS--(BUSINESS WIRE)--Xcel Energy Inc. (NASDAQ: XEL) today reported 2025 first quarter GAAP earnings of $483 million, or $0.84 per share, compared with $488 million, or $0.88 per share in the same period in 2024. First quarter ongoing earnings reflect higher O&M expenses, depreciation and interest charges, partially offset by increased recovery of infrastructure investments. “As we continue to advance our mission to make energy work better for our customers, we are building new gene.

XEL's first-quarter earnings are expected to have gained on the back of demand from its expanding customer base. However, an increase in operating expenses might have offset the positives.

Besides Wall Street's top -and-bottom-line estimates for Xcel (XEL), review projections for some of its key metrics to gain a deeper understanding of how the company might have fared during the quarter ended March 2025.

Xcel (XEL) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

PPL, Xcel Energy and American Electric Power are included in this Analyst Blog.

The 90-day tariff pause offers short-term relief, but long-term trade uncertainty and recession risks persist, making it critical to stay vigilant and strategic. Despite market volatility, now is the time to deploy cash into high-quality, dividend-paying stocks rather than raising cash. Focus on buying opportunities in dividend growth stocks, while being cautious with REITs like ARE and REXR due to trade war impacts.