XLU Stock Recent News

XLU LATEST HEADLINES

Looking for broad exposure to the Utilities - Broad segment of the equity market? You should consider the Utilities Select Sector SPDR ETF (XLU), a passively managed exchange traded fund launched on December 16, 1998.

The utility sector is booming while oil stocks continue to suffer from strong supply and weak demand. As a result, energy investors should prioritize the XLU Utility ETF over XLE. XLU components like NextEra and Vistra are well-positioned for AI-driven growth and clean-energy expansion, supporting the ETF's outperformance going forward. XLU offers relative safety, income, and growth, with a 2.7% yield and significant valuation discounts versus the S&P 500.

With rate cut odds climbing, ETFs like VNQ, XLU, XLY, IWM and GLD look likely to gain from a Fed move.

XLU surged to a 52-week high, gaining 21.5% from its low, as investor demand for defensive plays heats up.

Enphase and SolarEdge face short-term headwinds from unfavorable regulations and higher rates, but long-term structural tailwinds remain strong. Both companies are innovating with distributed energy solutions—AI, battery storage, microgrids, and EV integration—positioning themselves as future leaders in energy distribution. Long-term drivers, such as electrification, rising electricity demand and prices, declining battery costs, and the decentralization of energy networks could significantly boost growth and resilience.

U.S. GDP grew 3% in Q2 2025, beating forecasts and easing recession fears as investors eye VTV, XLU, DVY, DFUV and SPYD.

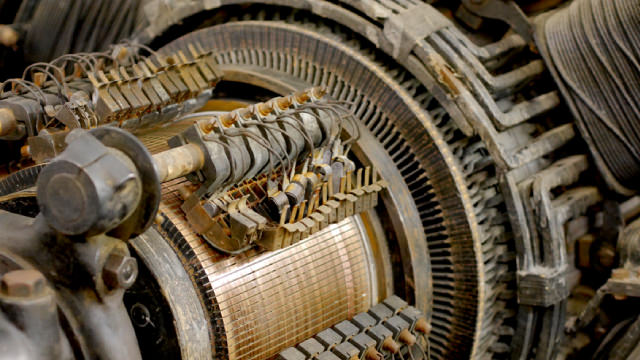

Thanks to AI, cloud computing, and renewable energy reshaping the global economy, one under-the-radar sector surging to the forefront is utilities. Long considered a sleepier, more defensive, “old economy” play, utilities stocks and ETFs are quickly becoming the backbone of the digital and green revolution.

'Fast Money' trader Carter Worth breaks down the technical indicators he is watching in the Utility sector after hitting 52-week highs.

The final trades of the day with CNBC's Melissa Lee and the Fast Money traders.

GE Vernova (GEV) rallied after its earnings while its sister company GE Aerospace (GE) did not. @Theotrade's Don Kaufman expects that trend to continue and has a bearish example options trade for GE Aerospace.