XOP Stock Recent News

XOP LATEST HEADLINES

The US will urge the Group of Seven to impose tariffs as high as 100% on China and India for their purchases of Russian oil in an effort to end the war in Ukraine. Brendan Murray reports on Bloomberg Television.

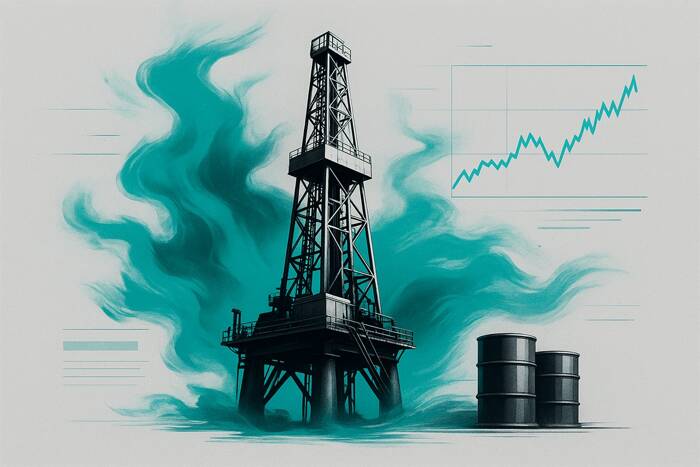

This past week has seen support showing up in the oil markets yet again, but at this point in time, the markets are still just a bit “stuck.” With this, the market continues to look for a bottom in this asset.

The crude oil market continues to see buyers on dips, as it looks like we are trying to find some kind of floor in this market. Oil has a few different issues to worry about, as the oversupply issues and of course the idea of a slowing economy are things

Most commodity prices were in the green on Friday with crude oil rising more than 1% due to geopolitical tensions in the Middle East and Ukraine. Gold prices continued to consolidate near all-time highs as the market waits for next week's US Federal Reserve policy meeting.

Saudi oil exports to China may hit 1.65M bpd in October, raising supply concerns despite uncertain long-term demand.

Crude oil extended its downside momentum Thursday, breaking from successive bear flags and pressing toward key Fibonacci and structural support zones, with sellers firmly controlling short-term direction.

Natural gas, WTI oil, and Brent crude all fell Thursday as oversupply fears and key technical breaks point to a bearish short-term energy outlook.

President Donald Trump says he's disappointed that India keeps buying oil from Russia.

The crude oil market continues to see a bit of noisy trading, as the markets are continuing to see a lot of questions about the supply of oil, as OPEC, Russia, and the United States are all pumping out massive amounts of petroleum.

The cartel held its oil-demand forecasts steady after agreeing to raise production again next month, doubling down on its strategy shift in a push for market share.