ZIM Stock Recent News

ZIM LATEST HEADLINES

ZIM Integrated Shipping Services (ZIM) came out with quarterly earnings of $0.19 per share, missing the Zacks Consensus Estimate of $1.5 per share. This compares to earnings of $3.08 per share a year ago.

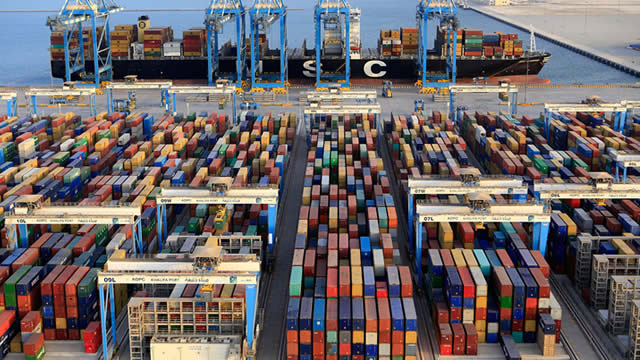

Reported Revenues of $1.64 Billion, Net Income of $24 million, Adjusted EBITDA1 of $472 Million and Adjusted EBIT1 of $149 Million 2 Guidance Midpoints Increased: Full Year 2025 Guidance of Adjusted EBITDA of $1.8 Billion to $2.2 Billion and Adjusted EBIT of $550 Million to $950 Million 3 Declared Dividend of $7 million, or $0.06 per Share HAIFA, Israel , Aug. 20, 2025 /PRNewswire/ -- ZIM Integrated Shipping Services Ltd. (NYSE: ZIM) ("ZIM" or the "Company") announced today its consolidated results for the three and six months ended June 30, 2025.

ZIM faces Q2 earnings with higher EPS estimates but steep year-over-year declines, rising costs, and trade tensions clouding its outlook.

Shares of ZIM Integrated Shipping Services (ZIM -3.83%) were up big this week before retreating. The stock had gained nearly 15% as trading began on Monday, but it is now up just 5.5% as of 2:33 p.m.

ZIM Integrated Shipping Services (ZIM) closed at $16.96 in the latest trading session, marking a -2.58% move from the prior day.

ZIM (ZIM) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

I maintain my Hold rating on ZIM Integrated Shipping, despite strong Q1 results and a potential go-private offer, due to looming industry headwinds. ZIM Integrated's Q1 outperformed expectations with robust revenue, high margins, and a generous dividend, but these may not be sustainable beyond 2025. Industry forecasts point to declining freight rates and oversupply, making ZIM's future earnings and dividends uncertain and raising value trap concerns.

HAIFA, Israel , Aug. 12, 2025 /PRNewswire/ -- ZIM Integrated Shipping Services Ltd. (NYSE: ZIM) ("ZIM" or the "Company") announced today that it is aware of the rumors in the market regarding a possible acquisition proposal.

ZIM Integrated Shipping Services Ltd (NYSE: ZIM) soared well over 15% on Monday following reports that its chief executive, Eli Glickman, has initiated an effort to take the company private.

ZIM Integrated Shipping Services (ZIM) closed at $15.5 in the latest trading session, marking a -2.7% move from the prior day.