If you are a dividend investor, your hopes of investing long-term using compounding can put you in a big financial hole if you don’t pay attention to the investing details which we are going to discuss in this video.

Hi, I am Henrikh and we are going to cover the pros and cons of dividend investing and a few major problems of dividend investing and compare that with value investing.

That's a fact that many people need steady cash flow from sources like dividends for their living expenses and that's maybe the most important part of dividend investing. But many times people waste their wealth blindly following the idea of a steady cash flow. So when your main focus is the periodic cash flow (monthly or quarterly), that doesn't mean that you must skip the asset value part. For example, If you buy a $100 stock and you get $5 annually as dividends while losing your asset value part with decreasing stock price and destroying your wealth, that's for sure not a good investment.

OK. Now if you want to be a very good dividend investor you must make sure you are investing in a very good company and that the stock price is not going to drop in the long run. In other words, you must fully investigate and analyze the company numbers and not only the numbers to make sure that the company is a great one and it is going to grow in the long run. Many dividend investors blindly follow the yield size which is almost promised by the company or the CEO of the company. But very often companies have big difficulties paying those dividends, which were almost promised earlier and by paying those dividends they don’t have enough resources to invest in growth so they lose their upside potential.

Usually, companies keep paying those dividends even if they finance those dividends with new debts or even if they are loaded with too much debt. There have been some cases where companies even paid those dividends before they finally crashed. So this means that when companies start paying dividends, they agree to have the mandatory expense because if they stop paying the dividends they will lose their status. Many dividend investors think that’s a good thing and they will benefit from it that companies will pay their dividends no matter what happens. But let’s go deeper, do you really want to increase the pressure on your own company? Do you want to make extra difficulties for the company you own? Do you want your own company to have many obligations or do you want to let it grow easier? Sometimes those obligations crush the companies. So the main question is: “Are you in the same team with business managers or against them?”. Remember if you need guaranteed paychecks, maybe you better invest in bonds or CDs or other guarantee-type instrument tools.

So to pick up a good company you must fully investigate the company, love it and believe that it will grow in the long run. Then you must value it and if your paying price is less than the real value of it, you can buy it. Valuing the company stock is based on the underlying business, not based on the yield size, which is the next big problem of many dividend investors. Many beginner dividend investors focus on the yield size only, but they forget that a dividend cut is not that rare thing in the stock market. And when it occurs, many investors sell their stocks because of the less yield and stock spirals down even faster. The company starts having bigger problems and is forced to cut dividends even further. Thus you must know your company's financials well. You must know that it will not have difficulties and will not struggle to pay your dividends in the future. This means you must value it ideally or almost ideally. And while doing this deep analysis to find the fair value of the company you are becoming more like a value investor rather than a dividend investor. Because if you believe that the company's future is bright, then you will want to leave the money within the company rather than taking it from them periodically. Also, you will skip the dividend taxation part so more money will stay on your or your company’s equity, rather than the government's equity. BTW, by saying value investor, I mean like Warren Buffett type of investor and the modern way of a value investor, not the old way like finding “cigar butt” companies.

At the end of the day, the only reason you will want to bring in some dividends is when you need the cash flow to your pocket for your living expenses which is mostly true when you are older rather than younger. Because when you are young enough, it is better to invest in your financial growth in the long run and surely have another income source for your living expenses like a job, personal business or something else.

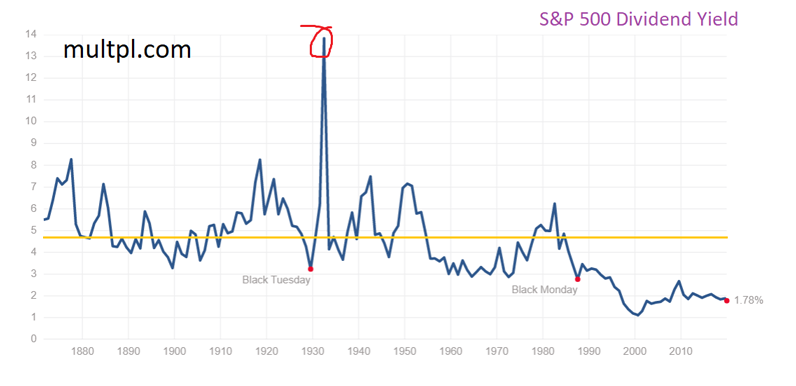

Also even if dividend investing is more of your type of investing, please pay attention when you start your dividend investing journey, because starting in 2020 can put you in big trouble as the market is way far from being undervalued and even being fair valued as of many reasons like S&P 500 total P/E ratio is too high compared to historical numbers, interest rates are at historic low, dividend yields are at historic low.

The S&P 500 total dividend yield was more than 13% in 1932 and now it is less than 2% only and historical dividend yields for the S&P 500 have typically ranged from between 3% to 5%. I would say the reason behind this low yield size is more connected with prices than dividends themselves. And investing in stocks and losing the asset value while being a dividend investor is as wrong and dangerous as being a value investor, growth investor or any type of investor. So starting investing in dividends when the market is crushed, might be a very good investment as we will have a high dividend yield together with stock price appreciation in the long run. But again we must not forget to invest only in wonderful companies, which we can value and predict better. And to select them, I would go deep in value as value investors usually do rather than just investing for yield size or stable quarterly cash flow, things that dividend investors like to mention.

Of course, nobody can time the market, but even if the market always goes up in the long run, that long run is about 50 or 100 years as there have been many times that the market went nearly nowhere for 10-20 or even almost 30 years. And in this case, if you invest only for dividends using today’s average yield size of under 2% will not give you an advantage against savings account, CDs or bonds, as they usually give that under 2% cash flow and are more risk-free than investing in stocks. So at the end of the day, if you prefer stocks to bonds or savings, this means you are betting against inflation and want to benefit from equity appreciation while being a dividend investor. So as if we cut out the equity appreciation, you would not prefer dividend stocks to saving accounts, which means that growth of your stock prices is one of the most important parts, if not the most important part of your investing strategy, while being a dividend investor.

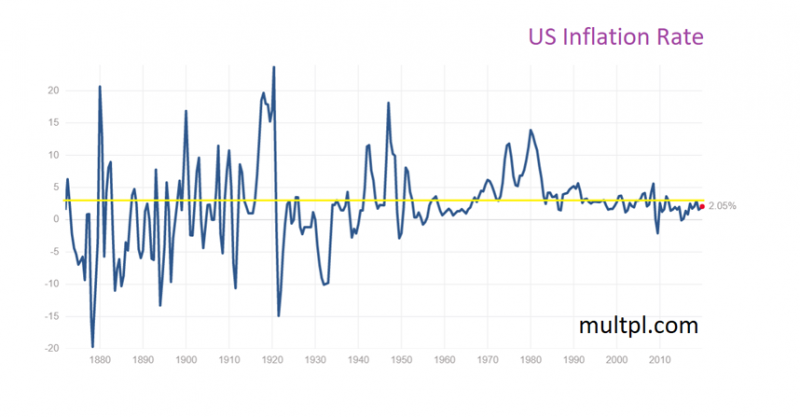

Another thing I want to cover is the inflation rate nowadays.

The official historical average inflation rate within the last 100 years is around 2-3%, if not even higher. In my opinion, the real inflation rate is way higher, but let’s play around with the official numbers. If your investments don’t grow in value, but will only provide you with 2-3% annual cash flow, you are not going to live a better life as the inflation rate is the same nowadays. The money you get after selling your stocks plus the 2-3% dividends will buy you the same things they buy now if the inflation rate stays 2-3%, and I am not talking about the hyperinflation times that we always have the risk to come.

So you better be sure that your selected company will rise in value in the future and you better use the “Margin of Safety” strategy to be safer in your investing journey.

To sum up, even if you want to be a dividend investor you must be partly or mostly a value investor to be successful, you must know the exact values of your selected companies. I am not against dividend investing, I just don't agree with the way most people understand it. If used properly, dividend investing could be a very good strategy also.