This is where many good analysts lose money: “Margin of Safety”, without which many of your investments can go bust, even if you are an expert on fundamental and technical analyses.

Hi, I am Henrikh and we are going to cover “Margin of Safety”. It is one of the major aspects of Value Investing and has a huge impact on your wealth when you choose to use or ignore it. You better invest time or money in yourself to be a great investor, otherwise, ignorance can be more expensive.

Benjamin Graham and David Dodd, the founders of value investing, described the term “Margin of Safety” in their books “Security Analysis” and “The Intelligent Investor”. Later Warren Buffett, “the number one investor in the world”, approved that strategy and wrote a lot about it. He wrote that this is one of the most important tricks in investing, if not number one. He also stated that the best investing book he ever read at a young age was “The Intelligent Investor” and at older ages, he still thinks the same way. You can find his forward message in Benjamin Graham’s book where he states that he mostly values chapter 8 and chapter 20 of “The Intelligent Investor”, while chapter 20 is all about the “Margin of Safety”.

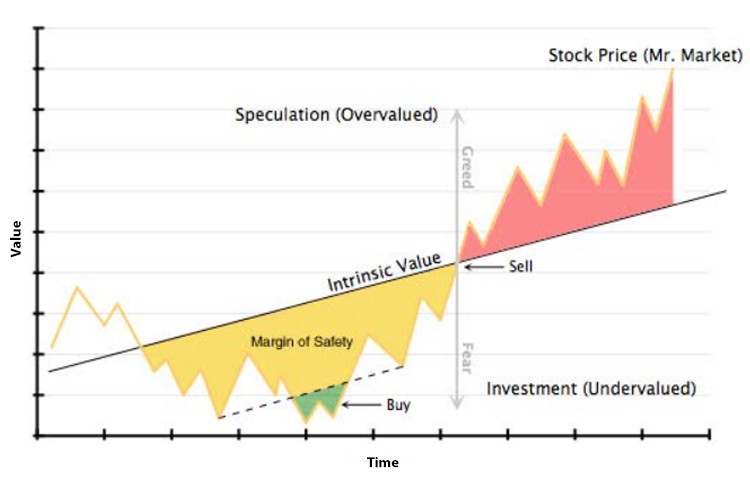

After covering the history of that term, let’s dig into the basics of it and later we will cover the most important parts of it, the very nuances that most investors don’t get right. In short: the “Margin of Safety” is the difference between the intrinsic value of the underlying you want to invest in and the price you want to pay. And by the way, this doesn’t refer to stocks only. This is true when you want to invest in anything, regardless if it is a stock, real estate, commodity or a private business. Before buying anything you need to find the real value of it. Remember the value is not the price. Not everything is trading on the price of its value, there is a big difference between value and price. As Warren Buffett wrote “Price is what you pay. Value is what you get.”

There are many entrepreneurs or flippers that buy real estate at 10% percent lower of its market price and sell at 10% higher of it, literally without improving it vastly. All they do is find a motivated seller to show the cash right away to buy cheaper and sell to someone who will emotionally connect to that real estate after they improve a few things to look nicer. Their improvement is not worth 20% percent of that real estate price, but the difference between their buying and selling price is 20% or even more. This was a great example only to understand that the price is not equal to the value. The flipper spent a little money and increased the value of the Real Estate. They buy a house paying $180,000, which is trading at about $200,000 and they spend 5-10 thousand dollars on it, by painting it all over like a fresh new, solving some problems the real estate has, upgrading the technical part in it and selling for about $220,000. The money they spent on rehabbing it is about 2-3% of the buying price, but the profit they make after selling it is about 20%. This is where the price doesn’t match the value. The most perfect example to show that price is not equal to value is buying self-education books. Like you spend $15 on 2-3 cups of coffee, which brings you some value for about 2-3 hours, and instead, you could buy a book, which could increase your financial IQ and make you a lot of money. Like those ten books, I spent money on, cost me about $200, but I earned more than $1000 within the next month after I read them all, using the techniques described there. And I can’t calculate how much money will they bring me in the future. This is where you understand that price has no connection to value.

So to use the “Margin of Safety” correctly, you must know the value of the underlying asset first and only after that you can buy it paying a lower price than its value. And the difference between the value and the price you want to pay is the “Margin of Safety”.

You need the “Margin of Safety” in case something goes wrong or you didn’t value the underlying correctly. When you ignore that safety your investments become risky against many factors.

What most professionals do is predicting the future true value of the underlying instead of trying to find the current value. And they try to bring the future value to the current intrinsic value. Let me explain this in detail as this is the most complicated part of value investing and where most investors do it wrongly. We understand that price is not always equal to the value, but we also know that one day in the future the price will be trading around the intrinsic value as the market is always trying to find the real value of the asset in the long run.

The father of value investing, Benjamin Graham, explained this by saying that in the short run, the market is like a voting machine, but in the long run, the market is like a weighing machine. The message is clear: in the long run, when the company performs well, so will the stock and when the company suffers, the stock will also suffer. So most professional investors try to find the future value of the company because they know sooner or later the price will meet the value. And they try to find the future value because businesses can have 0 growth later and holding it can be a losing strategy, even if they bought it at a great price. The current buying price is something connected to your financial goals or your needs and expectations. You must know exactly what are your minimal goals in investing and if met, then you are happy. So converting the future value to the current buying price you must use your numbers, which will make you happy. Let’s see that in an example.

Let’s say you predict a stock will be trading at about $1000 in ten years, now your next step is to convert that $1000 to today’s buying price. For this, we must use our own numbers. For me, it’s about a 15% return annually. If my investments grow at least 15% annually on average in the long run, that will make me really happy. So I would like to buy that stock at about $250 in today’s money, because if I add 15% annually to $250 for ten years it will be around $1000 in ten years, using compounding. So if that stock is trading at about $250 today that’s a perfect buying price for me, I would buy it, if not, then I would wait for that price to come. So the current intrinsic value for me is $250, the keyword here is “FOR ME”. If your investment goals are 10% annually and you will be happy with that, then you can buy the stock today at about $400. Because if we add up 10% annually on $400 we will have that $1000 in 10 years. In this example, I will not be happy buying the stock at $400, but you will. Here the most important message is: “The future value is something general for everybody, it depends on the business performance, but the current buying price can vary from person to person depending on the goals”.

We shortly covered how to find your buying price for today. Now let’s discuss the “Margin of Safety”. You don’t want to demolish all your ten-year investing plans when something unexpected happens or you miss something on valuing a company or the company meets some difficulties for a few years. So you want to meet your investment goals even when bad things happen. Thus you will need to buy the stock at a lower price than the actual price you were happy to pay. In the example above you were happy to pay $400, but you will need to buy it at around $200 or $300. Because you will need some capacity to be safer. Too many investors don’t make that extra deduction from buying price, that’s where they meet the financial unhappiness because unexpected things happen more than expected.