In this article, you'll learn how Warren Buffett sells options that bring him billions of dollars.

Hi, I'm Henrikh and we are going to cover options trading. Many people think that Warren Buffett only buys stocks and holds for a very long period, but he also sells many options. Why does Warren Buffett sell many options? Because he understands how time decay works to the benefit of the option sellers. Warren Buffett has collected billions and billions of dollars from option selling; he does it all the time. Option selling is an insurance business, and Warren Buffett loves the insurance business. Today I'll show you the logic behind his strategy.

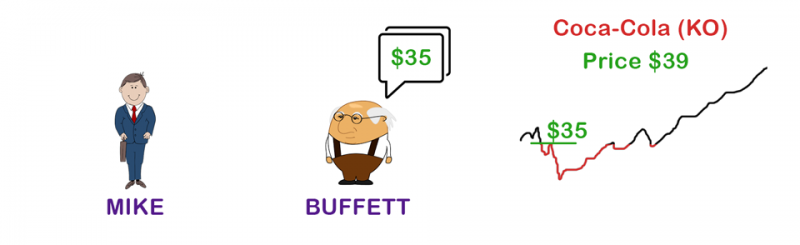

Ok, let's say this is Warren Buffett and over here is Mike, who is an investor as well. Now let's take a look at how Warren Buffett used put options to lower the cost basis of the Coca-Cola stock. In 1993 Buffett wanted to buy Coke, but at the price of about $35, while the Coke was trading at about $39. Based on his analysis, he was only willing to pay $35 per share. Based on his usual stock-picking strategy, I think Buffet thought if he could buy Coke at $35 per share, he would not panic if the price went down, as he was going to hold it for a very long period. So buying Coke at $35 definitely made sense.

So he sold PUT option contracts based on five mln shares at the strike of $35, and he collected $1.5 per share as an option premium, which in that case was a total $7.5 mln in the upfront. In other words, he made a promise to buy Coca-Cola shares at $35, and that promise should expire in a specific period, let's say three months. And he got $7.5 mln to make that promise.

So Mike, on the other hand, is the investor who paid the option premium of $1.5 per share to have a guarantee that he can sell his shares at $35 within the contract validity period. Mike has five mln Coca-Cola shares, and he is not willing to take the full risk. Maybe losing $4 per share is ok for him, but Mike doesn't want to risk more than that. Mike wants to have insurance, so by buying the put contracts, he gains an "option" to sell his shares at $35. So if the price drops below that level, he will take the benefit of that advantage and will accept the choice to sell at $35. That's like insurance. He pays the premium to be able to cover the losses if that happens. That's the rule of the insurance business. Whoever gets the promise to insure something, gets the money.

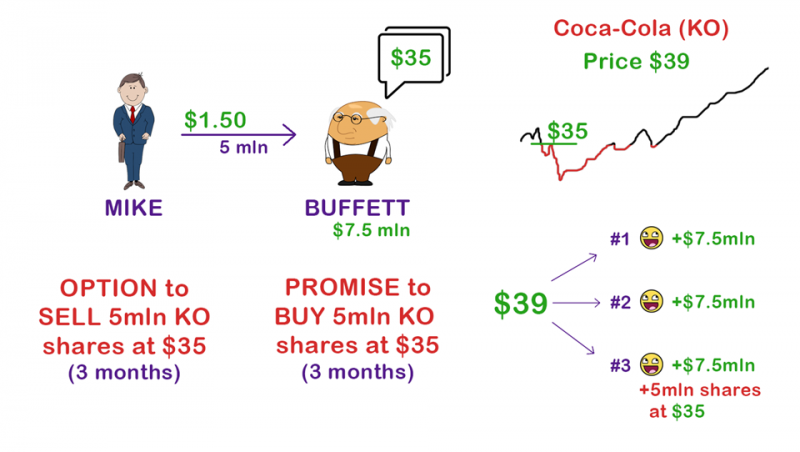

But Buffett doesn't have the choice; he has an obligation. If Mike wants, Buffett must buy the shares at $35 per share. And Mike will want to execute the contracts only in case when the price drops below $35; otherwise, Mike could sell it in the market at a higher price. But Buffett is ok with the price drop, as he was going to take that risk anyway. Buffett plans to buy the shares at $35 in the market, even without any option contract. In short, Buffett got paid $7.5 for doing something that he was planning to do anyway.

Imagine a case where you plan to go and buy some milk today in the supermarket at $35, and there is an opportunity that someone will pay you $1.5 to make that promise. Awesome right? Would you agree to make that guarantee? Sure.

Now, let's see what can happen next. Three things can happen. The stock price can go up, down, or stay sideways after Buffett sells the PUT contracts.

Case #1: The stock price goes up. So Buffett is happy because although the stock price didn't drop to $35 to make him buy the shares, he made $7.5 mln on the stock he never owned, and the promise expired, so Buffett pocketed the money for the promise he made, which has no validity anymore.

Case #2: The stock price remains sideways. Again Buffett is happy like in case #1 because again, he pocketed $7.5 mln on the stock he never owned, and the promise expired.

Case #3: The stock price goes down to $35 or lower. In this case, Buffett is still happy. Why? Because he still collected the $7.5 mln and plus he bought five mln shares of Coca-Cola stock at $35 per share, which he was planning to do anyway if the price reached that level. And if the price went lower than $35, he was going to take that risk anyway. He is a long-term value investor, which means that he doesn't care about short-term price fluctuations, and he plans to hold the share for a very long period being sure that the profit in the long term will pay it off.

The most exciting part here is that Buffett collected $1.5 in upfront regardless of the outcome. That means if he is obligated to buy the shares at $35, he still has received $1.5 out of this deal so that the real cost basis would be $33.5. So how many times can you do this contract-selling strategy as long as the price stays above $35? The answer is endless. You do it over and over unless the shares are put on your portfolio, making the cost basis lower and lower. Because each time you collect $1.5 per share, or whatever the contract price will be at that moment. Or, like in another scenario, that price never drops lower than the contract strike price, in that case, you collect the cash flow period after period, generating a nice income.

So does this strategy make sense? Sure. The logic behind being an intelligent investor is to invest in something that will make you happy in all directions. This is the advantage of being an advanced-level investor. This is the strategy Buffett made billions of dollars with.

This strategy is called a "naked put" or "cash-secured put" strategy. But the only reason that makes this strategy super is when you combine it with the value investing principles. Otherwise, many people sell put contracts on the stocks they are not going to buy anyway, so they dig a big hole they can't ever get out of. And they don't become happy when the price of the stock drops like in case #3.

The core happiness of this strategy shows up when you combine it with value investing principles. Imagine a case when you become very happy if you buy something at the price you want to buy, and someone pays you to make the promise to buy it at the price you would like to buy.

The last thing I want to tell you is that option contracts are considered as high-risk investment tools, so please don't trade until you get enough education. The education in this video is not enough for options trading as there are still many things to know before you do real things. If you are new to options, you still have to learn about Implied Volatility, Liquidity, Delta, Theta, differences between Out of Money and In the Money Options, and much much more.