ABNB Stock Recent News

ABNB LATEST HEADLINES

The generally rising market over the past few weeks have awakened the spirits of growth investors, and that's naturally also a wake-up call for Cathie Wood. The CEO, co-founder, and ace stock picker at Ark Invest was particularly busy on Tuesday, adding to 10 of her existing positions across her family of aggressive growth exchange-traded funds.

Airbnb, Inc. (ABNB) reached $135.54 at the closing of the latest trading day, reflecting a -2.36% change compared to its last close.

Airbnb (ABNB) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

The AI revolution will disrupt real estate. Some property sectors could face severe pain. I highlight popular REITs to avoid.

I initiate coverage of Airbnb with a Buy, as its core business remains strong and investments position it for long-term growth. Recent margin compression is due to strategic investments in Experiences & Services, and international expansion, which should drive future revenue streams. Despite Q1 growth deceleration, seasonality and currency movements mask underlying strength; cash flow and profitability remain robust.

SAN FRANCISCO , June 3, 2025 /PRNewswire/ -- On June 2, 2025, Airbnb (NASDAQ: ABNB) learned that the company and certain of its directors and executives were named as defendants in a lawsuit filed in the U.S. District Court for the District of Delaware by The Heritage Foundation and American Conservative Values ETF. The complaint alleges, among other things, that Airbnb improperly excluded certain shareholder proposals from its 2025 definitive proxy statement on Schedule 14A filed with the U.S. Securities and Exchange Commission on April 25, 2025 (the "Proxy Statement").

Analysts cut price targets across the U.S. hotel sector as expectations dip on wavering consumer confidence and a drop in inbound international travel.

The S&P 500 Index is clawing back its losses from earlier this year, as investor sentiment starts to improve. But not all businesses are trading anywhere close to their records.

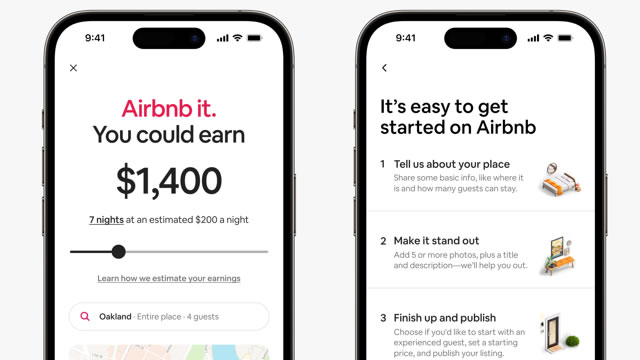

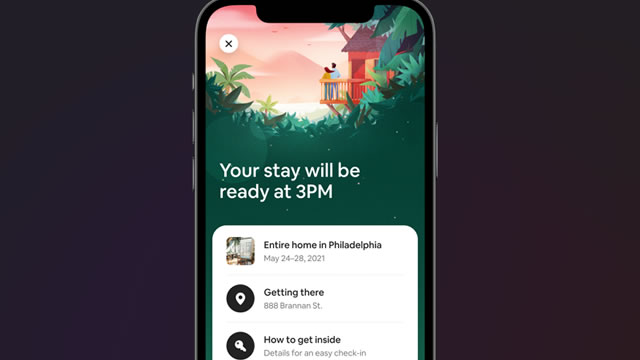

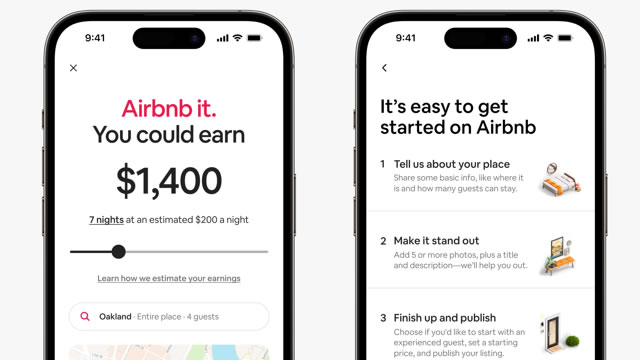

I upgrade Airbnb to 'Buy' with a $148 target, driven by its strategic expansion into services and experiences beyond accommodations. The redesigned app, launching in summer 2025, introduces new Homes, Experiences, and Services tabs to position ABNB as a holistic travel platform. I expect services and experiences to drive incremental bookings, potentially adding $1.5 billion in revenue and reviving growth above 10% YoY.