ACHR Stock Recent News

ACHR LATEST HEADLINES

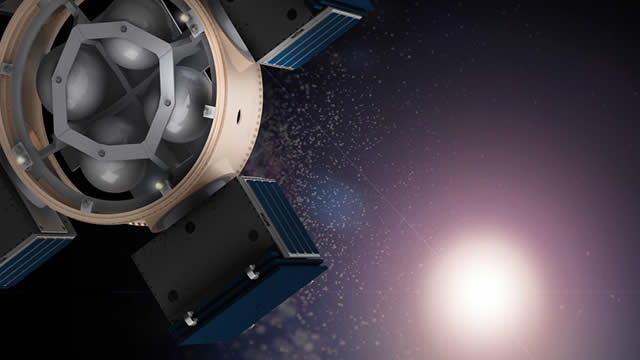

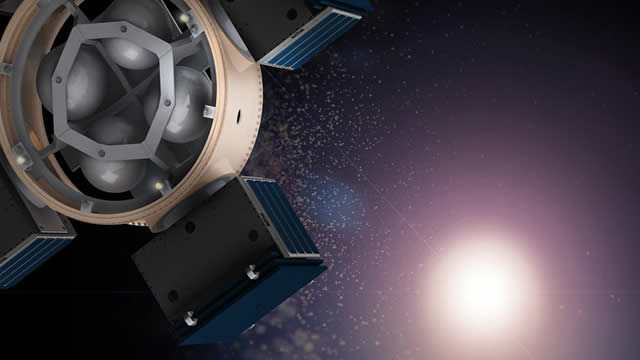

Archer Aviation (ACHR -0.81%) just completed the longest test flight yet of its Midnight aircraft, covering 55 miles at speeds of more than 125 miles per hour. The flight took just 31 minutes to complete.

Investing in the electric vertical takeoff and landing (eVTOL) market can be an exciting opportunity. Companies making this type of aircraft can capitalize on significant long-term growth opportunities, in what could be the next big travel trend.

Archer Aviation (ACHR -0.81%) is up 160% in a year -- without a single aircraft sale. Backed by a $6 billion order book, $1 billion in cash, and a UAE launch on deck, this eVTOL disruptor could soar, or worse, plummet.

ACHR's Midnight aircraft completes a 55-mile flight, marking progress toward certification and upcoming commercial launch plans.

Archer Aviation's NYSE: ACHR stock has recently captured significant market attention, with an increase in trading volume and positive price momentum that suggests a potential Wall Street frenzy is building. This renewed investor enthusiasm is grounded in a powerful series of back-to-back catalysts that demonstrate tangible progress for Archer.

Archer Aviation's Midnight eVTOL recently completed a piloted 31-minute, 51-mile piloted test flight.

Archer ended Q2 2025 with $1.724 billion liquidity after an $850 million raise, funding certification and manufacturing. Six Midnight aircraft are under build, three in final assembly, across Archer's 700,000 sq. ft. combined facilities. Midnight completed a record 55-mile, 31-minute piloted flight at 126 mph, validating safety envelope and regulator confidence.

SALINAS, Calif.--(BUSINESS WIRE)---- $ACHR #Archer--Archer Aviation (NYSE: ACHR) today announced that its Midnight aircraft successfully completed its longest piloted flight to date, flying approximately 55 miles in 31 minutes at speeds exceeding 126 mph. The flight took place at Archer's flight test facility in Salinas, California, in front of United Airlines' Chief Financial Officer, Mike Leskinen, who led United Airlines' early investment in Archer. Test flights in the preceding week reached speeds of nearly.

Archer Aviation (ACHR -1.45%) shareholders are experiencing turbulence while watching rival Joby Aviation (JOBY -4.26%) fly high. Archer's stock has dropped 13% over the past 30 days, while Joby's shares have climbed by nearly 2% in the same period.

Key Points in This Article: Archer Aviation (ACHR) expects to generate revenue by year-end via its UAE Launch Edition program, with payments in the low tens of millions of dollars.