ACHR Stock Recent News

ACHR LATEST HEADLINES

Undoubtedly, Joby Aviation (JOBY 18.82%) investors are keenly focused on insights into whether the electric vertical takeoff and landing (eVTOL) company is close to receiving the requisite Federal Aviation Administration (FAA) certifications.

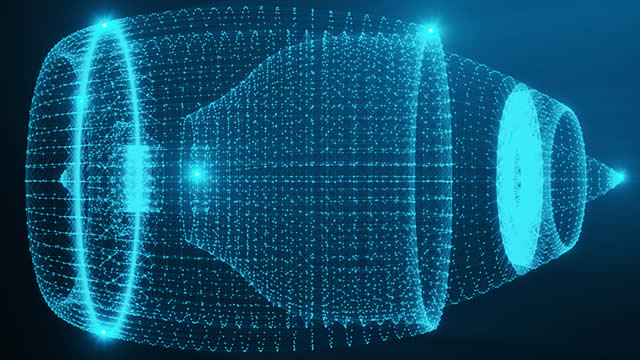

Archer Aviation (ACHR -3.54%) is an emerging company that's looking to make it big in the world of electric vertical take-off and landing (eVTOL) aircraft. It has big plans for growth and for investors, presenting them with an exciting way to invest in a business that may have a ton of potential to become much more valuable in the years ahead.

Industrial companies are often called the backbone of the economy. Year to date, they've also been the backbone of the stock market: As of late July, the sector has handily outpaced the broader S&P 500 (^GSPC -1.60%) with a 15% gain, almost double the index's return.

The latest trading day saw Archer Aviation Inc. (ACHR) settling at $10.03, representing a -1.18% change from its previous close.

The eVTOL market could be worth trillions, and Archer Aviation ACHR CEO Adam Goldstein says his company is leading the charge—even as he sees room for multiple players.