AIT Stock Recent News

AIT LATEST HEADLINES

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

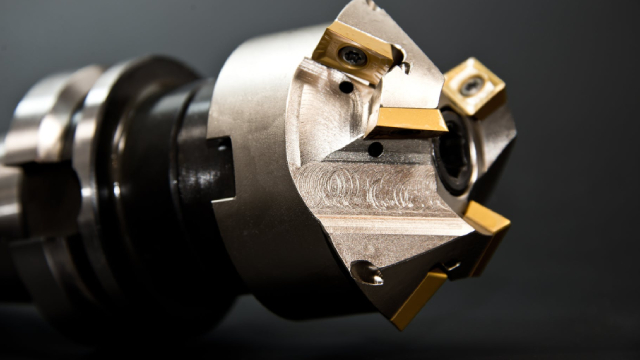

AIT's third-quarter fiscal 2025 revenues increase 1.8% year over year, driven by the solid performance of its Engineered Solutions segment.

While the top- and bottom-line numbers for Applied Industrial Technologies (AIT) give a sense of how the business performed in the quarter ended March 2025, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

Applied Industrial Technologies (AIT) came out with quarterly earnings of $2.57 per share, beating the Zacks Consensus Estimate of $2.40 per share. This compares to earnings of $2.48 per share a year ago.

CLEVELAND--(BUSINESS WIRE)--Applied Industrial Technologies (NYSE: AIT), a leading value-added distributor and technical solutions provider of industrial motion, fluid power, flow control, automation technologies, and related maintenance supplies, today reported results for its fiscal 2025 third quarter ended March 31, 2025. Net sales for the quarter of $1.2 billion increased 1.8% over the prior year. The change includes a 6.6% increase from acquisitions, partially offset by a negative 0.8% sel.

Get a deeper insight into the potential performance of Applied Industrial Technologies (AIT) for the quarter ended March 2025 by going beyond Wall Street's top -and-bottom-line estimates and examining the estimates for some of its key metrics.

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

CLEVELAND--(BUSINESS WIRE)--Applied Industrial Technologies (NYSE: AIT) today announced it will release its fiscal 2025 third quarter results on Thursday, May 1, 2025, before the market opens. The Company's fiscal 2025 third quarter ended March 31, 2025. The Company will host a conference call at 10 a.m. ET that day to discuss the quarter's results and outlook. A live audio webcast and supplemental presentation can be accessed on our Investor Relations site at https://ir.applied.com. To join by.

Investors need to pay close attention to Applied Industrial Technologies (AIT) stock based on the movements in the options market lately.

Slowdown in new orders, supply-chain issues and rising costs weigh on the Zacks Manufacturing - General Industrial industry's near-term prospects. DOV, RBC, AIT and DNOW are a few stocks to gain.