AIT Stock Recent News

AIT LATEST HEADLINES

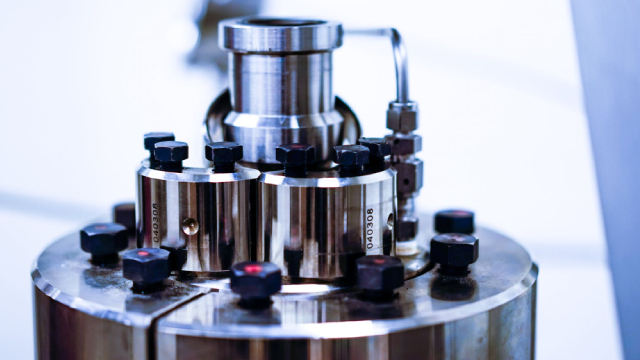

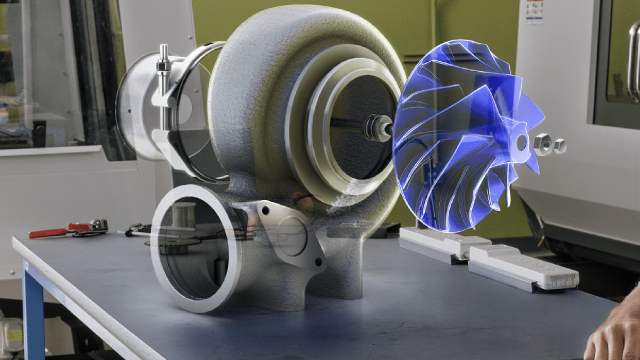

Strength in the Service Center unit, driven by increased demand in the semiconductor sector, bodes well for AIT. The company's shareholder-friendly policies are promising.

Applied Industrial Technologies (AIT) witnesses a hammer chart pattern, indicating support found by the stock after losing some value lately. This coupled with an upward trend in earnings estimate revisions could mean a trend reversal for the stock in the near term.

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

Here is how Applied Industrial Technologies (AIT) and DNOW (DNOW) have performed compared to their sector so far this year.

Explore how Applied Industrial Technologies' (AIT) revenue from international markets is changing and the resulting impact on Wall Street's predictions and the stock's prospects.

Excited to announce dividend hikes for 23 companies, including dividend kings SJW Group and California Water Service Group, with 5% and 7.1% increases. Companies with consistent dividend growth indicate financial health, attracting investors and boosting stock prices, leading to long-term wealth accumulation. Investment strategy focuses on stocks with rising dividends and outperforming benchmarks, using data from U.S. Dividend Champions and NASDAQ.

Stocks like AIT, GHM, AZZ and ENSare likely to benefit from the jump in manufacturing activity.

Here is how Applied Industrial Technologies (AIT) and Core & Main (CNM) have performed compared to their sector so far this year.

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

Although the revenue and EPS for Applied Industrial Technologies (AIT) give a sense of how its business performed in the quarter ended December 2024, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.