ARM Stock Recent News

ARM LATEST HEADLINES

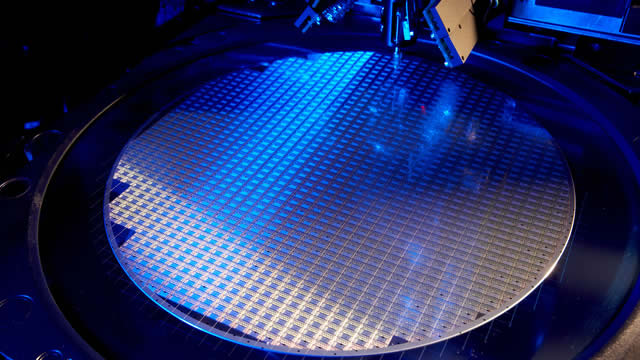

Chip stocks trend as profit-taking meets massive AI spending plans, led by $250B+ investments from Meta, Microsoft, and Google.

Trump's punches against Intel's new CEO land a direct hit — widening the opening for the tech giant's strongest rivals.

A glowing analyst note ignited a mini-rally in chipmaker Arm Holdings (ARM 1.76%) on Monday. Taking the bullish tone of the report to heart, many investors loaded up on the stock, pushing it to a nearly 2% price increase on the day.

British technology company Arm Holdings (ARM 2.10%) has witnessed a remarkable surge in its stock price since April 7, when its shares were trading at a 52-week low, driven by the broader rally in technology stocks.

Litasco Middle East (LME) DMCC, a trading arm of Russia's Lukoil, is shifting its business to a newly-created Dubai-based entity, four sources familiar with the matter said, as Western powers tighten sanctions around Russian energy exports.

The Nasdaq Composite (^IXIC -0.65%) advanced 857% during the last two decades, equivalent to an annual return of 12%. That period covers such a broad range of economic and stock market conditions that investors can be reasonably confident in similar returns in the future.

Commscope shares surged nearly 70% in early trading on Monday after Amphenol announced it would acquire the company's Connectivity and Cable Solutions business for $10.5 billion in cash. The deal will expand Amphenol's presence in the data communications market, particularly in areas linked to artificial intelligence and advanced data centre infrastructure.

Warren Buffett's never been a big fan of technology stocks. He says they're too difficult to understand and often vulnerable to change.

Arm Holdings (ARM -2.68%) felt something like an unwanted limb over the past few days, largely because of an earnings report that struck the wrong chord with more than a few investors. Several analyst price target cuts only highlighted this disappointment.

Arm CEO Rene Haas discusses where the company is headed on 'The Claman Countdown.' #foxbusiness #claman #stocks #computing