ARM Stock Recent News

ARM LATEST HEADLINES

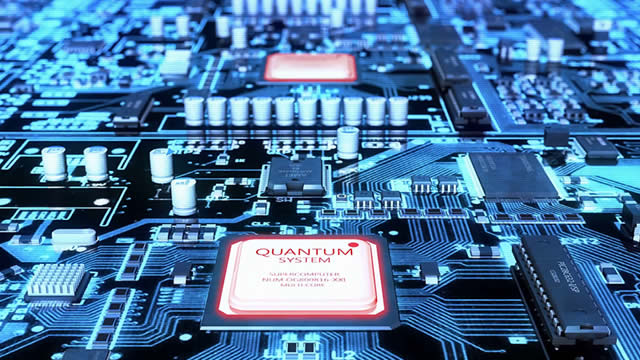

Key Points in This Article: Arm Holdings (ARM) aims to capture 50% of the data center CPU market by 2025, up from 15% in 2024, primarily displacing x86 leaders Intel and AMD. The data center CPU market is projected to grow from $7.42 billion in 2024 to $8.35 billion in 2025, with Arm’s success potentially boosting its revenue to $3.3–3.4 billion and market cap to as much as 168.3 billion. Arm’s goal faces skepticism due to x86’s entrenched ecosystem, but its energy-efficient designs and hyperscaler adoption make it a formidable contender. On a Mission to Dominate British chip design titan Arm Holdings (NASDAQ:ARM) sent shockwaves through the tech industry earlier this year with a bold claim: it aims to capture 50% of the data center CPU market by the end of 2025, up from 15% in 2024. This ambitious goal threatens to reshape the competitive landscape, challenging x86 giants Intel (NASDAQ:INTC) and Advanced Micro Devices (NASDAQ:AMD). As artificial intelligence (AI) and cloud com

ARM's Q1 revenues are likely to rise 11%, but with earnings expected to fall and valuation stretched, timing is key for investors.

Artificial intelligence mania is still going strong, readily rekindling bullish interest in many of the industry's stocks while continuing to lift others. Investors understand that most of these tickers are already well overvalued.

The ultimate win for investors is finding a remarkable company that is not only highly productive, but also capable of growth over many years, resulting in substantial returns for long-term shareholders.

Arm Holdings (ARM -0.30%) has emerged as one of the top semiconductor and artificial intelligence (AI) stocks on the market today. After going public in 2023, the stock soared as investors realized it had more exposure to AI than they initially believed.

Arm Holdings (ARM -0.30%) has long stood out in the semiconductor industry, particularly regarding its mobile phone processors. Instead of manufacturing these processors, it earns revenue by licensing its designs to companies such as Samsung, Apple, and Qualcomm.

Arm Holdings (ARM -0.30%) stock has underperformed the technology sector of late. It is trading down about 16% from its all-time high set in mid-2024, while the tech-focused Nasdaq Composite index is trading at or near all-time highs despite enduring a tough time earlier this year.

Arm Stock: The Nvidia partner is approaching a new buy point following strong gains this week, rebounding from a key level.

MVST looks more compelling than ARM right now, with cheaper valuation and strong momentum in next-gen battery tech.

The Nasdaq-100 index had an outstanding month in June. The index, consisting of the 100 largest non-financial stocks listed on the Nasdaq stock market, gained 6.3% in June.