AXP Stock Recent News

AXP LATEST HEADLINES

Subscribers to Schaeffer's Weekend Trader options recommendation service received this AXP commentary on Sunday night, along with a detailed options trade recommendation -- including complete entry and exit parameters.

Investors looking for ways to boost their passive income stream recently saw encouraging results from a pair of well-established dividend payers. Verizon (VZ -0.26%) raised earnings guidance for the last half of 2025, and American Express (AXP 1.50%) delivered second-quarter revenue that set a new record.

NEW YORK--(BUSINESS WIRE)--American Express Company (NYSE: AXP) today announced that Randal K. Quarles and Noel Wallace have been elected to its Board of Directors, effective July 23, 2025. With these appointments, the American Express Board increases to 14 members. Mr. Quarles has served as the Executive Chairman and Co-Founder of The Cynosure Group, a diversified investment firm, since 2022. He previously served as Vice Chairman for Supervision of the Board of Governors of the Federal Reserve.

NEW YORK--(BUSINESS WIRE)--The Board of Directors of American Express Company (NYSE: AXP) declared a quarterly dividend on the Company's 3.550% Fixed Rate Reset Noncumulative Preferred Shares, Series D, of $9,072.22 per share (which is equivalent to $9.07222 per related Depositary Share). The dividend is payable on September 15, 2025, to shareholders of record on September 1, 2025. ABOUT AMERICAN EXPRESS American Express (NYSE: AXP) is a global payments and premium lifestyle brand powered by te.

SAN FRANCISCO , July 22, 2025 /PRNewswire/ -- Rakuten, the leading Cash Back shopping platform, today announced the launch of the Rakuten American Express® Card in the U.S., exclusively for Rakuten members. The Rakuten Card, powered by Imprint, turns shopping into an even more rewarding experience, offering cardholders industry-leading Cash Back rewards with no annual fee, along with unique offers, experiences, and protections from the American Express network.

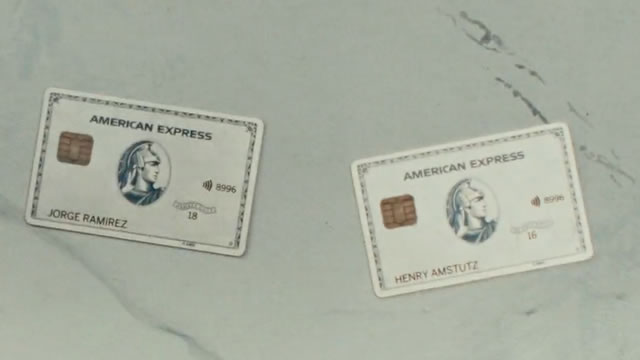

American Express (AXP -0.85%) reported Q2 2025 results on July 18, with revenues of $17.9 billion (up 9% year over year) and earnings per share of $4.08 (up 17% excluding last year's gain from the sale of Certified). The company reaffirmed its full-year revenue growth guidance range of 8% to 10% and EPS guidance of $15 to $15.50, while highlighting record net card fees, a strong premium portfolio, and the impending refresh of U.S. Platinum cards.

Is your retirement nest egg where it needs to be right now? That is to say, is it big enough at this stage of your life to ensure it will be big enough then?

At the age of 94 and currently in his last year as CEO of Berkshire Hathaway, it would be easy to view Warren Buffett as an old-fashioned investor. But you don't become the best investor of all time by staying in the past.

I've always appreciated dividend stocks as a solid strategy for any investment portfolio. While I recognize the importance of growth stocks (and hold several of them), stocks that represent companies that pay a solid, consistent dividend also are an important tool for growing wealth.

The final trades of the day with the Fast Money traders.