AXP Stock Recent News

AXP LATEST HEADLINES

The market is rebounding after plunging earlier this year, continuing its bull run and reaching new highs. Legendary investor Warren Buffett has made it clear many times what he thinks about bull markets: He's a contrarian investor who prefers to buy stocks when they're in bargain territory.

Investors looking for stocks in the Financial - Miscellaneous Services sector might want to consider either Intercorp Financial Services Inc. (IFS) or American Express (AXP). But which of these two stocks presents investors with the better value opportunity right now?

AmEx may top Q2 estimates as strong network volumes, card growth, and rising interest income offset cost pressures.

The Dow Jones Industrial Average is sometimes viewed as a low-growth, value-focused index. But the Dow has modernized -- adding Nvidia (NVDA -0.09%), Amazon, and Salesforce over the last five years.

Looking beyond Wall Street's top-and-bottom-line estimate forecasts for American Express (AXP), delve into some of its key metrics to gain a deeper insight into the company's potential performance for the quarter ended June 2025.

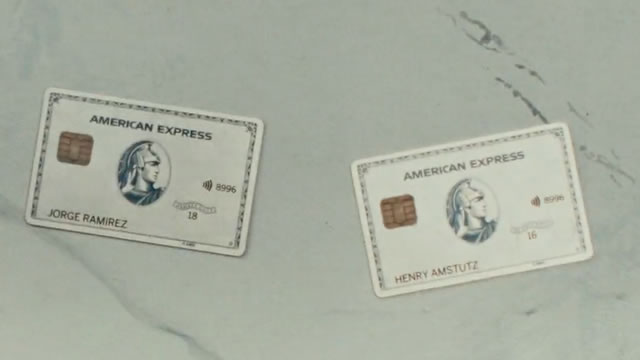

Spending $5,000 or more each month isn't unusual for some cardholders -- especially business owners, frequent travelers, or large families. But not all credit cards can handle that volume. Many standard cards come with credit limits that cap out well below $20,000.If you need more flexibility (and want strong rewards, too), these three cards stand out. They also offer valuable perks and earnings rates that'll make them a mainstay in your wallet for years to come. (function(){function c(){var b=a.contentDocument||a.contentWindow.document;if(b){var d=b.createElement('script');d.innerHTML="window.__CF$cv$params={r:'95f1953ce827aac8',t:'MTc1MjUwMjAxMC4wMDAwMDA='};var a=document.createElement('script');a.nonce='';a.src='/cdn-cgi/challenge-platform/scripts/jsd/main.js';document.getElementsByTagName('head')[0].appendChild(a);";b.getElementsByTagName('head')[0].appendChild(d)}}if(document.body){var a=document.createElement('iframe');a.height=1;a.width=1;a.style.position='absolute';a.style.top=

Some credit cards give you 1% cash back and a pat on the back. Others hand you airport lounge access, elite hotel upgrades, and spending limits big enough to book a round-the-world trip.Today I'm covering three of the coolest, most perk-loaded cards on the market. Holding one of these bad boys can get you VIP treatment, $30K+ spending power, and the kind of benefits that feel like first class, even when you're sitting in coach. (function(){function c(){var b=a.contentDocument||a.contentWindow.document;if(b){var d=b.createElement('script');d.innerHTML="window.__CF$cv$params={r:'95f1951bbc8e38e4',t:'MTc1MjUwMjAwNS4wMDAwMDA='};var a=document.createElement('script');a.nonce='';a.src='/cdn-cgi/challenge-platform/scripts/jsd/main.js';document.getElementsByTagName('head')[0].appendChild(a);";b.getElementsByTagName('head')[0].appendChild(d)}}if(document.body){var a=document.createElement('iframe');a.height=1;a.width=1;a.style.position='absolute';a.style.top=0;a.style.left=0;a.style.border='non

Investors looking for ways to find stocks that are set to beat quarterly earnings estimates should check out the Zacks Earnings ESP.

Pre-Markets Red on Trump's Tariff Threats to Canada.

American Express (AXP) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.