CCF Stock Recent News

CCF LATEST HEADLINES

Even a cursory examination of Bill Ackman and Chase Coleman's respective portfolios shows few common denominators. The two billionaire hedge fund managers have quite different styles and investment strategies.

ConocoPhillips tops Q2 earnings estimates, boosts Marathon Oil resource outlook and eyes $2B in annual savings after full integration.

Trump says JPMorgan Chase, Bank of America rejected him as a bank customer

Investors probably don't expect huge gains from businesses that operate in a very mature industry like financial services. But JPMorgan Chase (JPM -1.13%) has shown that it can be a big winner.

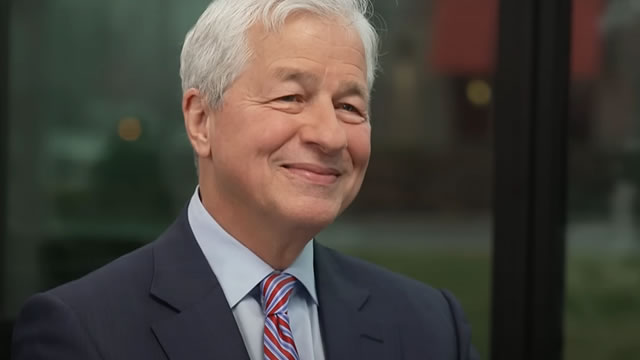

JPMorgan Chase Chairman and CEO Jamie Dimon joins CNBC's Leslie Picker to talk the Federal Reserve, the state of the U.S. economy, tariffs and more.

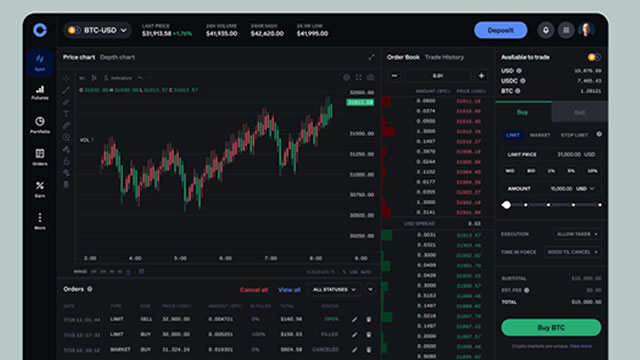

JPMorgan Chase and Coinbase partnered to make it easier for their mutual customers to buy cryptocurrency. The companies expect to launch a new feature in the fall that will enable customers to use Chase credit cards to fund their Coinbase accounts, according to a Wednesday (July 30) press release.

JPMorgan Chase said its credit-card rewards points will be transferrable into Coinbase accounts.

WASHINGTON--(BUSINESS WIRE)--The Independent Restaurant Coalition (IRC) and Chase today announced a multi-year partnership to offer meaningful support to independent restaurants and bars as they continue to be vital employers and leaders in communities nationwide. This new partnership includes two grant programs – the IRC and Chase Disaster Relief Fund and the IRC and Chase Innovator Awards – that together will award $4 million in grants to independent restaurants and bars across the country th.

JPMorgan Chase and Apple have been negotiating since last year, according to The Wall Street Journal.

JPMorgan Chase and Apple are reportedly close to reaching a deal in which the bank would become the tech giant's credit card partner. The companies have been negotiating since early 2024, and those talks have accelerated, the Wall Street Journal (WSJ) reported Tuesday (July 29), citing unnamed sources.