EADSY Stock Recent News

EADSY LATEST HEADLINES

Dublin-based aircraft lessor Avolon set out on Thursday a new order with Paris-listed planemaker Airbus for 75 A321neo and 15 A330neo aircraft.

Airbus and Boeing have been competing head to head for decades as the world's largest commercial airplane makers, but Airbus has pulled ahead in recent years by several measures. Over the past few years, Airbus has beat Boeing when it comes to net profits, aircraft orders, deliveries and backlog.

EADSY strengthens global momentum with a new H160 order from Japan, supporting rescue and firefighting roles.

European plane maker Airbus and U.S.-based Kratos Defense have partnered to supply combat drones to the German Air Force by 2029, Airbus said on Wednesday.

Embraer's CEO warned tariffs could harm the company as much as the pandemic did. Trump has proposed a 50% levy on Brazilian exports.

Investors interested in stocks from the Aerospace - Defense sector have probably already heard of Huntington Ingalls (HII) and Airbus Group (EADSY). But which of these two companies is the best option for those looking for undervalued stocks?

Airbus Group (EADSY) might move higher on growing optimism about its earnings prospects, which is reflected by its upgrade to a Zacks Rank #1 (Strong Buy).

EADSY, VRTS and IBKR made it to the Zacks Rank #1 (Strong Buy) momentum stocks list on July 11, 2025.

Airbus said on Thursday that Lars Wagner would become the CEO of its commercial aircraft business from January 1, 2026.

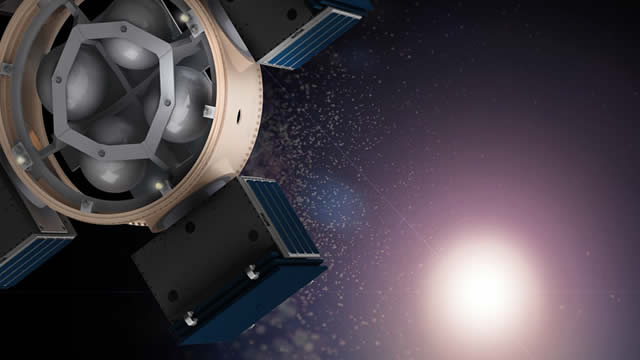

Airbus' Defence and Space unit has been selected by Spanish satellite operator Hisdesat to build two advanced PAZ-2 radar satellites for Spain's defence ministry, the company said on Wednesday.