FCX Stock Recent News

FCX LATEST HEADLINES

The Global X Copper Miners ETF offers diversified exposure to global copper mining equities, which tracks the Solactive Global Copper Miners Total Return Index. COPX's performance is highly correlated with copper prices, which are heavily influenced by Chinese industrial demand and global economic trends. COPX is the largest and most liquid copper miners ETF, with a 1.51% yield and a 0.65% expense ratio.

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

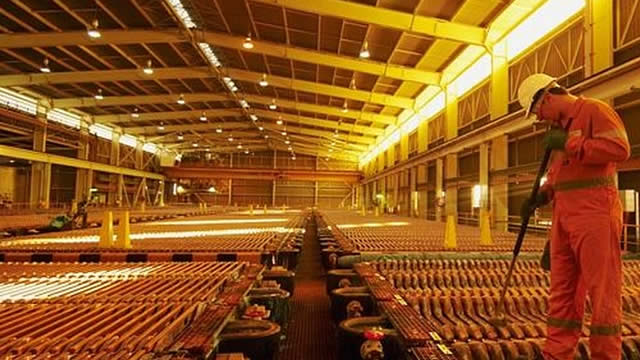

PHOENIX--(BUSINESS WIRE)--Freeport (NYSE: FCX) announced today that expert teams continue to work around the clock to locate seven PT Freeport Indonesia (PTFI) team members whose access routes in the Grasberg Block Cave were blocked following the previously reported September 8 mud flow incident. Extensive efforts are ongoing to clear access routes to the service level of the mine where the seven contractors were working at the time of the incident. The wet material entered the mine through dra.

LOS ANGELES--(BUSINESS WIRE)---- $FCX--FCX Investors Have Opportunity to Join Freeport-McMoRan Inc. Fraud Investigation with the Schall Law Firm.

Mining giant Freeport-McMoRan (FCX) stock fell 5.9% on Tuesday after rival Anglo American agreed to acquire Canada's Teck Resources for $53 billion, marking the sector's second-largest M&A deal and creating one of the world's biggest copper miners. The merger highlights intensifying competition in the copper market, where demand is rising on the back of electric vehicles, renewable energy, and artificial intelligence.

PHOENIX--(BUSINESS WIRE)--Freeport (NYSE: FCX) announced that on Monday, September 8 at approximately 10 p.m. local time in Central Papua, Indonesia, a large flow of wet material from a production drawpoint occurred at one of five production blocks in the Grasberg Block Cave underground mine. The incident blocked access to certain areas within the mine, restricting evacuation routes for seven team members. The location of the workers is known, and they are believed to be safe. Crews are working.

Freeport-McMoRan (NYSE:FCX) has increased by 19% year-to-date, but the stock is increasingly perceived as Unattractive due to its moderate operational performance and financial condition. While there is strength in copper prices and improving demand influenced by electrification and renewable energy trends, the company's operational leverage leaves it highly vulnerable to commodity fluctuations, and even slight declines in copper prices could significantly impact earnings.

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

Freeport-McMoRan is the premier U.S. copper producer, trading at a significant discount to peers and supported by bullish technical indicators. Copper's long-term demand is driven by electrification, clean energy, and AI, while supply remains constrained, setting up a multi-year bull market. Freeport's robust project pipeline, innovative leach technologies, and management share buybacks reinforce my conviction in its long-term value.

Despite the Zacks Mining-Non Ferrous industry's weak near-term outlook, stocks like SCCO, FCX, FQVLF, CDE and LEU are worth keeping an eye on.