FCX Stock Recent News

FCX LATEST HEADLINES

Freeport-McMoRan (NYSE:FCX) is scheduled to announce its earnings on Wednesday, July 23, 2025. The consensus earnings are estimated to be approximately $0.44 per share, and revenues are projected to rise by nearly 5% compared to the same quarter last year.

Shares rallied nicely, but have run out of steam.

Subscribers to Chart of the Week received this commentary on Sunday, July 13.

The Zacks Style Scores offers investors a way to easily find top-rated stocks based on their investing style. Here's why you should take advantage.

CNBC's Jim Cramer delivers his thoughts on one stock, Freeport-McMoran.

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

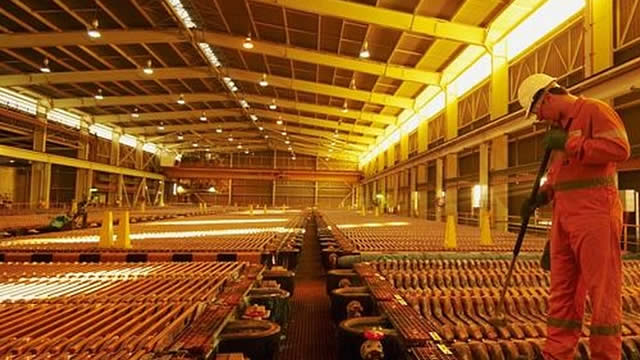

A shift to more domestic production could take years. Copper prices and mining stocks are rising.

Shares of US-based copper giant Freeport-McMoRan climbed 3.75% to $47.30 in premarket trading on Wednesday, as investors reacted to a new 50% tariff on imported copper announced by former President Donald Trump.

Key Points in This Article: President Trump's just-announced 50% tariff on copper imports aims to boost domestic production, causing a 13% surge in U.S.

Freeport-McMoRan (FCX) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.