HOOD Stock Recent News

HOOD LATEST HEADLINES

While the top- and bottom-line numbers for Robinhood Markets (HOOD) give a sense of how the business performed in the quarter ended June 2025, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

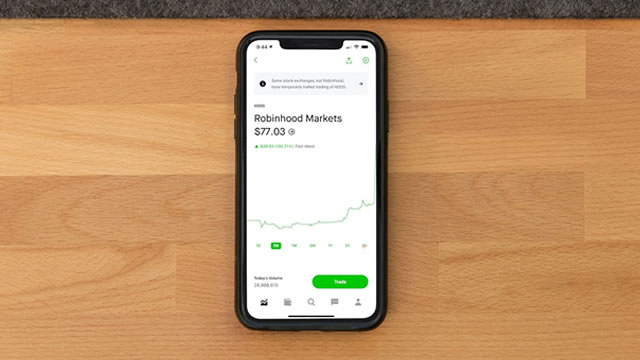

Robinhood Markets on Wednesday (July 30) delivered second-quarter 2025 results that reveal a company pivoting sharply from its roots in commission-free retail trading toward a diversified, multilane financial platform. The company's Q2 2025 earnings showed a 45% year-over-year revenue surge to $989 million and a doubling of diluted earnings per share to $0.42.

Robinhood Markets, Inc. (HOOD) came out with quarterly earnings of $0.42 per share, beating the Zacks Consensus Estimate of $0.31 per share. This compares to earnings of $0.21 per share a year ago.

Robinhood and AppLovin are the two largest companies that aren't in the index. Both companies were snubbed during recent additions.

CNBC's MacKenzie Sigalos joins 'Closing Bell Overtime' with RObinhood results.

Robinhood Markets (HOOD) reported a blowout earnings beat

Stock and cryptocurrency trading platform Robinhood Markets Inc. HOOD reported second-quarter financial results after market close Wednesday.

Robinhood stock looked to decline after its Q2 report Wednesday. Cryptocurrency revenue soared, but not enough for analysts.

The retail trading platform logged a 45% leap in sales as cryptocurrency, options and equities drove revenue.

Retail investors bought the recent stock market dip at record rates in response to volatility, likely helping boost Robinhood's business.