HOOD Stock Recent News

HOOD LATEST HEADLINES

Meta, Netflix, Robinhood Markets and DoorDash stand out as founder-run companies with strong vision, innovation, and long-term growth drivers.

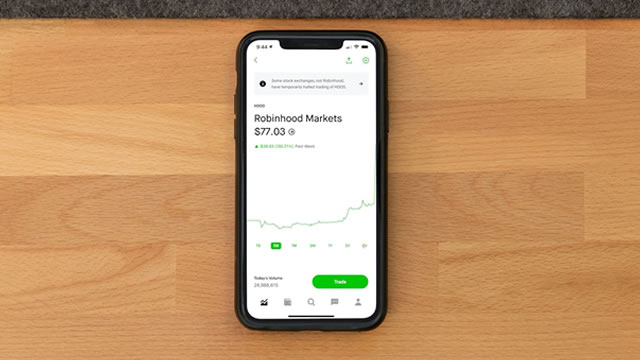

Robinhood stock price will be in the spotlight this week as the blue-chip company publishes its financial results. HOOD jumped to over 2.5% in the premarket session, up by over 268% from its lowest level in April, and its market capitalization hit $95 billion.

Robinhood Markets HOOD is set to announce second-quarter 2025 results on July 30 after market close. Robinhood's first-quarter 2025 performance was impressive.

Robinhood Markets (HOOD 2.87%) has experienced an impressive surge over the past year, capturing investors with its remarkable turnaround. After facing scrutiny for its payment-for-order-flow business model and its role in the 2021 meme stock frenzy, the company is becoming a formidable player in the financial landscape.

In January, I highlighted Robinhood Markets (HOOD 2.79%) as a stock to buy for long-term investors, despite doubts about whether the company could do more than disrupt the brokerage industry. Back then, it was trading around $40 per share, and many still questioned its staying power.

Buying and holding shares of growing companies can lead to massive wealth creation over the long term. Some of the best companies to invest for the long term are those that provide popular services for the masses.

NFLX, HOOD and AFRM made the momentum cut with strong 1-year gains and brief pullbacks, flashing a potential entry point.

Get a deeper insight into the potential performance of Robinhood Markets (HOOD) for the quarter ended June 2025 by going beyond Wall Street's top-and-bottom-line estimates and examining the estimates for some of its key metrics.

HOOD trades at a steep premium. Can bold global moves, crypto growth and diversification justify the price?

Top-ranked stocks Affirm (AFRM), Roku (ROKU), Amazon.com (AMZN), Robinhood Markets (HOOD) and Newmont (NEM) are likely to beat on the bottom line in their upcoming releases.