LHX Stock Recent News

LHX LATEST HEADLINES

Rising defense spending puts KTOS and LHX in focus as both enjoy significant traction in next-gen defense tech.

Global military expenditure climbed by nearly 10% between 2023 and 2024, reaching $2.7 trillion last year as spending accelerated faster since the Cold War. Ongoing conflicts throughout Eastern Europe and the Middle East threaten to continue driving a worldwide race toward defense growth into the foreseeable future.

For more than a year now, I've been warning investors that defense stocks cost too much. At first, that warning seemed prescient, when shares of almost all of America's leading publicly traded defense companies declined within months of my sounding the alarm.

CEO and chief investment officer of Ark Invest Cathie Wood earned a reputation for making high-conviction bets on disruptive, speculative opportunities aimed at toppling legacy incumbents in markets such as financial services, technology, and pharmaceuticals. When it comes to artificial intelligence (AI) stocks, it's no surprise that Wood has taken a liking to data analytics powerhouse Palantir Technologies, the third-largest holding across Ark's exchange-traded funds (ETFs).

Great stock picking blends Benjamin Graham's value principles, Peter Lynch's real-world insights, and Warren Buffett's focus on durable moats. It's about buying undervalued businesses, not just stocks. I invest like an owner, targeting companies I'd hold forever. Whether tech or oil, the goal is the same: margin of safety + secular growth. My picks combine deep value, strong cash flows, and competitive edges. Market highs don't scare me, and mispriced opportunities exist if you know where to look.

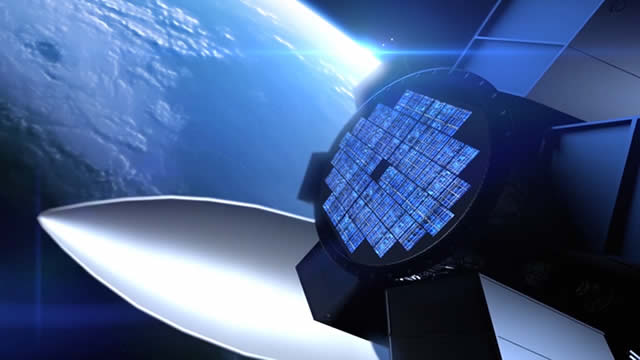

MELBOURNE, Fla., - L3Harris Technologies (NYSE: LHX) has appointed Rob Mitrevski as President, Golden Dome Strategy and Integration, a new role created to lead the company's pursuit of the U.S. government's next-generation missile defense initiative. Mitrevski will spearhead enterprise-level efforts to enable a multi-domain, layered architecture, overseeing cross-functional teams spanning satellites, datalinks, multi-domain ISR, precision fire-control sensing and propulsion and control systems for interceptors. aAdsList.push('Article'); aAdsListSize.push([300, 250]); aAdsListCA.push(null); 'Rob's appointment reflects the strategic importance we place on the Golden Dome program and our responsiveness to the urgent timeline identified by President Trump,' said Christopher E. Kubasik, Chair and CEO, L3Harris. 'This program is an opportunity for unprecedented innovation and industry collaboration, and it will serve as a cornerstone of future U.S. defense strategy.' Mitrevski brings more th

JBL, HEI, and LHX have each surged over 17% in three months, fueled by strong drone tech momentum and rising defense demand.

Many investors have been piling into defense stocks in the first half of 2025. The last four years have brought escalating geopolitical tensions, including Russia's war with Ukraine, Israel fighting a two-front war in Gaza and Iran.

The U.S. defense industry is unmatched, backed by nearly $1 trillion in annual spending, supporting my long-standing investment in dividend-paying giants. A new wave of disruptors is shaking things up, blending AI and autonomy to chase growth, but sky-high valuations demand caution and realism. I prefer reliable incumbents, but I'm closely tracking promising innovators, because in this evolving battlefield, both camps may win big.

SYLMAR, Calif.--(BUSINESS WIRE)-- #3ATI--IEE moves to the production phase of a contract with L3Harris to deliver hundreds of 3ATI Electric Warfare (EW) Multi-Function Displays (MFDs).