LHX Stock Recent News

LHX LATEST HEADLINES

ROCHESTER, N.Y.--(BUSINESS WIRE)--L3Harris Technologies (NYSE: LHX) has received multiple orders expected to total $214 million under Germany's Digitalization – Land Based Operations (D-LBO) program. These orders include delivery of interoperable communication systems to enhance the operational capabilities of the German armed forces. “Resilient and immediate communication among allies is crucial for countering threats posed by aggressive adversaries,” said Sam Mehta, President, Communication S.

L3Harris Technologies is set to work on modifications to a used Qatari Boeing 747 that could be used as a new Air Force One aircraft. Boeing's modifications on a pair of 747 jumbo jets to become the new Air Force One aircraft is years behind schedule and more than $2 billion over budget.

The U.S. government has commissioned defense contractor L3Harris Technologies to overhaul a Boeing 747 formerly used by the Qatari government to use as an interim Air Force One, the Wall Street Journal reported on Thursday.

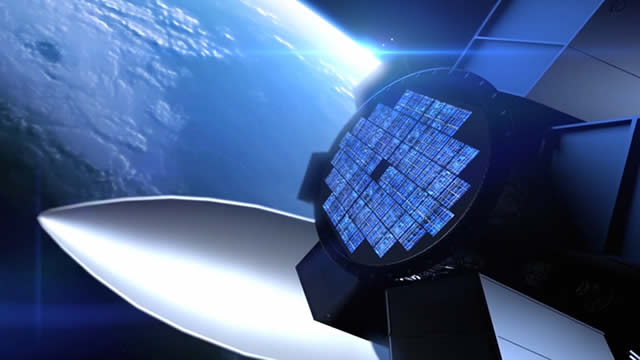

L3Harris Technologies, a major defense contractor, has a strong order backlog of $34 billion and expects a revenue boost from expanding space and aviation programs. The company's flexible business model and strategic acquisitions, like Aerojet Rocketdyne, position it well in niche markets such as tactical communications and electronic warfare. Despite high competition and dependence on the US defense budget, L3Harris shows strong financials, with a 2024 net income of $1.502 billion and a 7% net margin.

MELBOURNE, Fla.--(BUSINESS WIRE)--L3Harris Technologies (NYSE: LHX) Chief Financial Officer and Aerojet Rocketdyne President Ken Bedingfield will present at Barclays Americas Select Franchise Conference in London at 8:30 a.m. local (3:30 a.m. ET) on Tuesday, May 6. The presentation will stream live on the L3Harris website, with a recording available after the event. Bedingfield will also present at the Wolfe Research Conference at 12:50 p.m. ET on Thursday, May 22, in New York City. The present.

Despite a 2% stock price decline, L3Harris Technologies remains a buy due to its strong market position and better performance than the S&P 500. The company's diverse segments, particularly Communication Systems, show significant growth potential, with a focus on cyber, ISR, and hypersonics. First quarter earnings reveal mixed results, with overall sales down but profits growing, particularly in Communication Systems and Aerojet Rocketdyne.

L3Harris Technologies, Inc. (NYSE:LHX ) Q1 2025 Earnings Conference Call April 24, 2025 10:30 AM ET Company Participants Dan Gittsovich – Vice President-Investor Relations Chris Kubasik – Chair and Chief Executive Officer Ken Bedingfield – Senior Vice President, Chief Financial Officer and President-Aerojet Rocketdyne Conference Call Participants Seth Seifman – J.P. Morgan Ronald Epstein – Bank of America Doug Harned – Bernstein Sheila Kahyaoglu – Jefferies Matt Akers – Wells Fargo Noah Poponak – Goldman Sachs Robert Stallard – Vertical Research Partners Myles Walton – Wolfe Research Jason Gursky – Citigroup Michael Ciarmoli – Truist Securities Peter Arment - Baird Operator Greetings.

LHX's Q1 revenues of $5.13 billion miss the Zacks Consensus Estimate by 1.9% and decline 1.5% year over year.

The headline numbers for L3Harris (LHX) give insight into how the company performed in the quarter ended March 2025, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

L3Harris (LHX) came out with quarterly earnings of $2.41 per share, beating the Zacks Consensus Estimate of $2.32 per share. This compares to earnings of $3.06 per share a year ago.