LHX Stock Recent News

LHX LATEST HEADLINES

Great stock picking blends Benjamin Graham's value principles, Peter Lynch's real-world insights, and Warren Buffett's focus on durable moats. It's about buying undervalued businesses, not just stocks. I invest like an owner, targeting companies I'd hold forever. Whether tech or oil, the goal is the same: margin of safety + secular growth. My picks combine deep value, strong cash flows, and competitive edges. Market highs don't scare me, and mispriced opportunities exist if you know where to look.

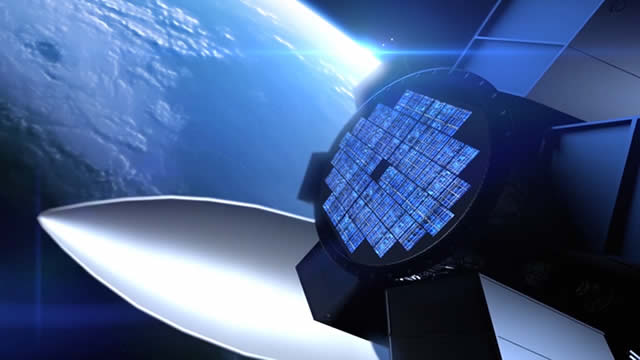

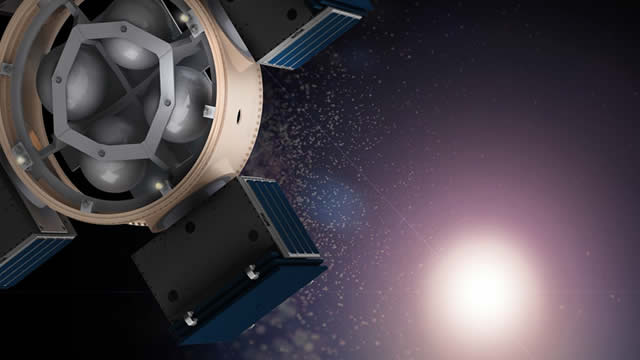

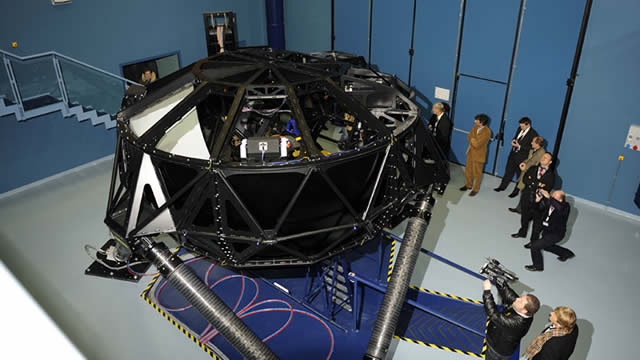

MELBOURNE, Fla., - L3Harris Technologies (NYSE: LHX) has appointed Rob Mitrevski as President, Golden Dome Strategy and Integration, a new role created to lead the company's pursuit of the U.S. government's next-generation missile defense initiative. Mitrevski will spearhead enterprise-level efforts to enable a multi-domain, layered architecture, overseeing cross-functional teams spanning satellites, datalinks, multi-domain ISR, precision fire-control sensing and propulsion and control systems for interceptors. aAdsList.push('Article'); aAdsListSize.push([300, 250]); aAdsListCA.push(null); 'Rob's appointment reflects the strategic importance we place on the Golden Dome program and our responsiveness to the urgent timeline identified by President Trump,' said Christopher E. Kubasik, Chair and CEO, L3Harris. 'This program is an opportunity for unprecedented innovation and industry collaboration, and it will serve as a cornerstone of future U.S. defense strategy.' Mitrevski brings more th

JBL, HEI, and LHX have each surged over 17% in three months, fueled by strong drone tech momentum and rising defense demand.

Many investors have been piling into defense stocks in the first half of 2025. The last four years have brought escalating geopolitical tensions, including Russia's war with Ukraine, Israel fighting a two-front war in Gaza and Iran.

The U.S. defense industry is unmatched, backed by nearly $1 trillion in annual spending, supporting my long-standing investment in dividend-paying giants. A new wave of disruptors is shaking things up, blending AI and autonomy to chase growth, but sky-high valuations demand caution and realism. I prefer reliable incumbents, but I'm closely tracking promising innovators, because in this evolving battlefield, both camps may win big.

SYLMAR, Calif.--(BUSINESS WIRE)-- #3ATI--IEE moves to the production phase of a contract with L3Harris to deliver hundreds of 3ATI Electric Warfare (EW) Multi-Function Displays (MFDs).

L3Harris has evolved into a high-margin, diversified defense technology leader, uniquely positioned in communications, avionics, and rocket engines after recent acquisitions. Despite mixed Q1 2025 revenue, margin expansion and cost optimization drove strong profit growth; management expects further EPS and margin improvements for the year. My DCF and valuation models indicate L3Harris is moderately undervalued, with a base-case upside of 14% and limited downside risk, supporting a Buy rating.

Defense stocks don't always make headlines, until something goes wrong. Over the past year L3Harris Technologies Inc. has been doing what a lot of investors want right now, which is staying steady, delivering results, and building long-term contracts.

As one part of his “Make America Great Again” agenda, President Donald Trump is proposing the construction of a “Golden Dome” defense system. This comprehensive, mobile air defense system will be similar to the Golden Dome that protects Israel.

L3Harris Technologies, Inc. (NYSE:LHX ) Bernstein 41st Annual Strategic Decisions Conference May 29, 2025 9:00 AM ET Company Participants Chris Kubasik - Chair and Chief Executive Officer Ken Bedingfield - Senior Vice President and Chief Financial Officer Conference Call Participants Douglas Harned - Bernstein Douglas Harned Okay. Good morning.