LRCX Stock Recent News

LRCX LATEST HEADLINES

The headline numbers for Lam Research (LRCX) give insight into how the company performed in the quarter ended June 2025, but it may be worthwhile to compare some of its key metrics to Wall Street estimates and the year-ago actuals.

LRCX, ADBE, DIS and YUM use strong moats to fend off rivals and deliver consistent returns amid market shifts.

Lam Research Corporation (NASDAQ:LRCX ) Q4 2025 Earnings Conference Call July 30, 2025 5:00 PM ET Company Participants Douglas R. Bettinger - Executive VP & CFO Ram Ganesh - Vice President of Investor Relations Timothy M.

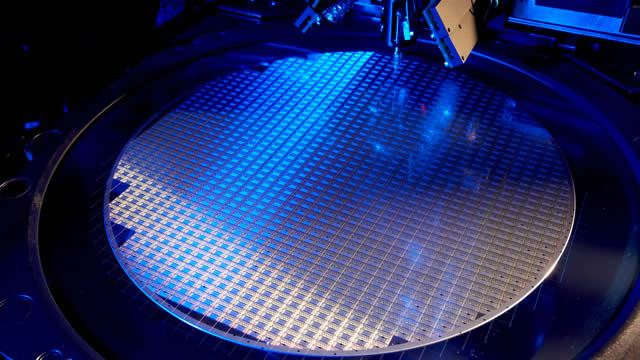

Lam Research has a wide moat due to advanced technology, patents, scale, and integration with top chipmakers, making it difficult to replace. The company benefits from secular growth in some sectors of semiconductors, driven by AI, smart devices, and demand for more powerful, efficient chips. Recurring revenue streams from post-sales services and spare parts add stability and higher margins, rare for hardware companies.

FREMONT, Calif. , July 30, 2025 /PRNewswire/ -- Lam Research Corporation (the "Company," "Lam," "Lam Research") today announced financial results for the quarter ended June 29, 2025 (the "June 2025 quarter").

Lam Research's Q4 results are likely to gain from a rebound in the semiconductor industry, driven by the surging demand for memory and advanced AI applications.

Lam Research (LRCX) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

The Investment Committee discuss their top picks in the semiconductor sector.

The article provides a methodology for selecting high-growth dividend-paying stocks, focusing on dividend growth and sustainability rather than high current yield. We use our proprietary models to rate quantitatively and qualitatively and select the top ten names from an initial list of nearly 400 dividend stocks. The final list of ten stocks is chosen based on sector diversity, high-growth quality scores, and positive momentum, suitable for investors in the accumulation phase.

Dutch semiconductor equipment manufacturer ASML (ASML -9.22%) warned investors that its sales might not grow at all in 2026, and the bad news isn't just crashing ASML stock -- it's taking down rival semi equipment maker Lam Research (LRCX -2.22%) as well.