LRCX Stock Recent News

LRCX LATEST HEADLINES

When deciding whether to buy, sell, or hold a stock, investors often rely on analyst recommendations. Media reports about rating changes by these brokerage-firm-employed (or sell-side) analysts often influence a stock's price, but are they really important?

FREMONT, Calif. , May 14, 2025 /PRNewswire/ -- Lam Research Corp. (Nasdaq: LRCX) today announced that Tim Archer, President and Chief Executive Officer, and Doug Bettinger, Executive Vice President and Chief Financial Officer, will participate in the following upcoming investor events: Tim Archer: Bernstein Strategic Decisions Conference on May 28, 2025, at 7:00 a.m.

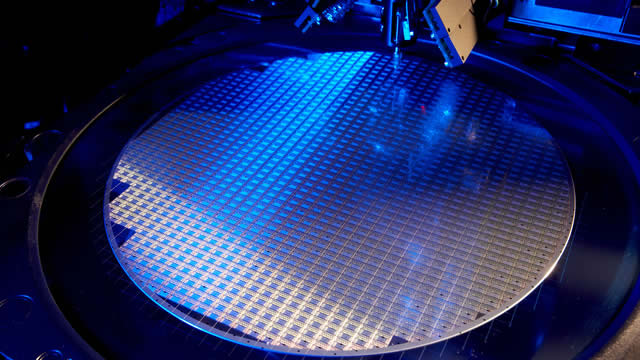

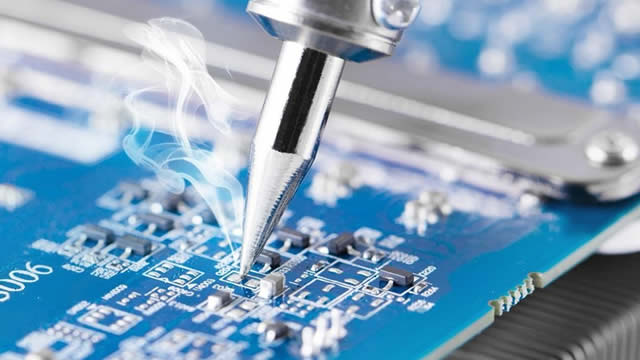

Semiconductor stocks have struggled since last summer, with the SMH ETF underperforming the broader market and several individual names experiencing sharp corrections—a familiar pattern in this highly cyclical industry.

The best investments are often stocks of companies offering goods and services that are perpetually in demand. Think entertainment, healthcare, or more recently, some consumer technologies.

I present 63 high-quality dividend growth stocks for investment for May 2025, categorized by yield: High (4%+), Medium (2.5-3.9%), and Low (

I rank a selection of undervalued dividend growth stocks in Dividend Radar and present the top ten stocks for consideration. I use two valuation screens, one based on my fair value estimate, and another comparing each stock's forward dividend yield with its 5-year average dividend yield. To rank stocks, I do a quality assessment and sort candidates by quality scores, breaking ties with additional metrics.

“Mad Money” TV show host Jim Cramer is a popular, though somewhat over-the-top showman.

Lam Research, Unity Software and Gulfport Energy are exhibiting strong earnings acceleration.

The average of price targets set by Wall Street analysts indicates a potential upside of 26.8% in Lam Research (LRCX). While the effectiveness of this highly sought-after metric is questionable, the positive trend in earnings estimate revisions might translate into an upside in the stock.

Investors often turn to recommendations made by Wall Street analysts before making a Buy, Sell, or Hold decision about a stock. While media reports about rating changes by these brokerage-firm employed (or sell-side) analysts often affect a stock's price, do they really matter?