MDT Stock Recent News

MDT LATEST HEADLINES

Medtronic delivered solid earnings, with standout growth in Cardiovascular, but overall performance remains mixed due to weaker Neuroscience and MedSurg segments. Elliott Management's activist involvement and new board appointments could drive operational improvements and strategic divestitures, echoing past success at Cardinal Health. Valuation is attractive on a PEG basis, but I remain on hold, awaiting clear evidence of sustainable earnings momentum and operational execution.

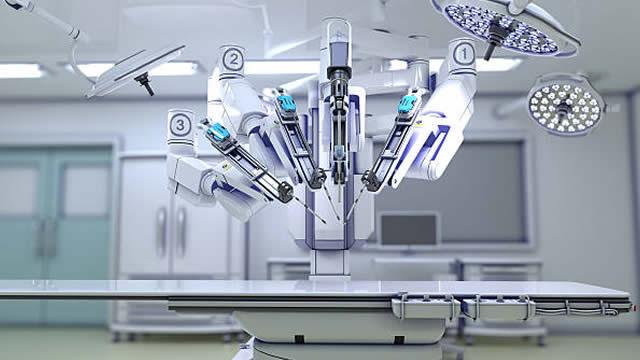

Medtronic (MDT -0.31%), a global medical technology leader specializing in cardiovascular, neuroscience, and surgical devices, reported Q1 FY2026 earnings on August 19, 2025. The most notable news from the release was a strong beat on both profits and revenue: Non-GAAP earnings per share reached $1.26, compared to estimates of $1.23, while Non-GAAP revenue hit $8.54 billion, $160 million above expectations. The company also raised its full-year FY26 non-GAAP EPS outlook, supported by solid revenue growth in its Cardiovascular and Diabetes segments. Overall, The quarter showed continued operational momentum, but also revealed ongoing margin pressures and a major portfolio move with the planned spin-off of the Diabetes business. Source: Analyst estimates provided by FactSet. Management expectations based on management's guidance, as provided in Q4 2025 earnings report. Medtronic develops and manufactures a wide range of medical devices, including implantable cardiac pacemakers, heart val

Medtronic (NYSE:MDT), which is renowned for inventing the world's first battery-operated implantable pacemaker, has over time earned respect as a worldwide leader in medical technology and has created substantial value for its shareholders. Although the company's advancements have influenced contemporary healthcare, its stock presents a more cautious narrative today.

If you are looking to buy some dividend stocks right now, you'll want to get to know Realty Income (O 1.28%), PepsiCo (PEP 1.02%), and Medtronic (MDT -1.02%). All three are reliable dividend payers with historically high yields, which suggests they are on sale.

Publicly traded corporations are under no obligation to pay dividends. Among those that do, many are rather subpar in the exercise, particularly with how often they raise their payouts.

Now is an opportune time to focus on income stocks like that offer value and stability amid market volatility. I focus on 2 Dividend Aristocrats that are attractively valued while supporting well-covered dividends. Both carry A/A+ rated balance sheets and have potential for strong total returns with a solid starting yield.

Several years ago I bought shares of 3M (MMM -1.73%) even though it was in the middle of a major class-action lawsuit. I believed the industrial giant would survive the legal issues, which it has.

GALWAY, Ireland , June 12, 2025 /PRNewswire/ -- Medtronic plc (NYSE: MDT), a global leader in healthcare technology, today announced MiniMed as the name for the planned New Diabetes Company following the intended separation. The name honors the company's roots, reflecting its original name prior to its acquisition by Medtronic in 2001, and a deep 40-year history of being at the forefront of transforming diabetes care around the world.

With both MDT & ABT focusing on their core strengths, the stage is set for a compelling comparison. Let's see which stock is poised for greater upside.

The new diabetes company will be predominantly business-to-consumer, while Medtronic's model was more business-to-business.