MRVL Stock Recent News

MRVL LATEST HEADLINES

In a world where investors are used to seeing AI firms report exciting growth in data centre revenue – Marvell Technology Inc (NASDAQ: MRVL) came in shy of expectations on that front in Q2. Naturally, investors bailed on MRVL shares today, making it close down nearly 20%.

Marvell Technology's 15% stock drop is overblown, given strong 69% YoY data center growth and robust AI demand from major hyperscalers. Despite minor guidance miss, Marvell remains highly profitable, with a forward P/E of 18 and a PEG ratio of 0.64, making shares extremely cheap. Sales and EPS growth are likely to remain strong, supporting my Strong Buy rating and $105 price target, with Wall Street also bullish.

Q2 Net Revenue: $2.006 billion, a new record, grew by 58% year-on-year Q2 Gross Margin: 50.4% GAAP gross margin; 59.4% non-GAAP gross margin Q2 Diluted income per share: $0.22 GAAP diluted income per share; $0.67 non-GAAP diluted income per share Financial outlook for the third quarter of fiscal 2026 reflects the divestiture of Marvell's Automotive Ethernet business on August 14, 2025 SANTA CLARA, Calif. , Aug. 28, 2025 /PRNewswire/ -- Marvell Technology, Inc. (NASDAQ: MRVL), a leader in data infrastructure semiconductor solutions, today reported financial results for the second quarter of fiscal year 2026.

Calgary, Alberta--(Newsfile Corp. - August 18, 2025) - Marvel Biosciences Corp. (TSXV: MRVL) (OTCQB: MBCOF), and its wholly owned subsidiary, Marvel Biotechnology Inc. (collectively "Marvel" or the "Company"), a drug discovery company developing novel therapeutics for autism spectrum disorder and related conditions, today announced that the China National Intellectual Property Administration (CNIPA) has granted patent number ZL202180020893.4, titled "Purine Compounds for Treating Disorders". The patent covers the composition of matter for Marvel's lead asset, MB-204.

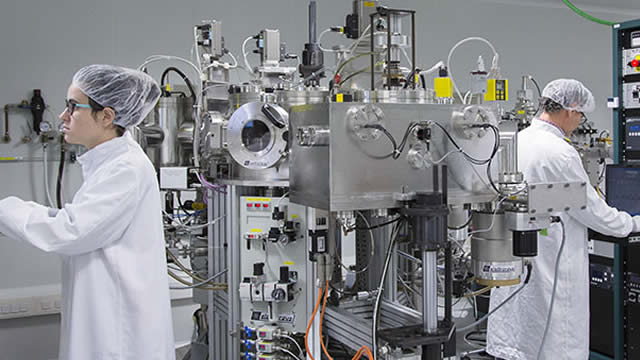

Marvell Technology's surging Data Center revenues are fueled by custom AI XPUs, optics advances, and cutting-edge chip packaging innovations.

Chip stocks trend as profit-taking meets massive AI spending plans, led by $250B+ investments from Meta, Microsoft, and Google.

Marvell is a value Buy in the AI-driven semiconductor space, with robust growth prospects and relative undervaluation versus peers. Strong Q1 FY2026 results and guidance, driven by AI and data center demand, support a multi-year high growth thesis for Marvell. Key risks include heavy China exposure and geopolitical uncertainties, which are already factored into current valuations.

Calgary, Alberta--(Newsfile Corp. - August 11, 2025) - Marvel Biosciences Corp. (TSXV: MRVL) and its wholly owned subsidiary, Marvel Biotechnology Inc. (collectively the "Company" or "Marvel"), announces the award of 142,987 deferred share units ("DSUs") to two of Marvel's directors, in lieu of cash payment for directors' fees. The DSUs will all vest on July 31, 2026.

SANTA CLARA, Calif. , Aug. 4, 2025 /PRNewswire/ -- Marvell Technology, Inc. (NASDAQ: MRVL), a leader in infrastructure semiconductor solutions, today announced it will conduct a conference call following the release of its second quarter of fiscal year 2026 financial results on Thursday, August 28, 2025, at 1:45 p.m.

Marvell Technology Inc (NASDAQ: MRVL) rallied as much as 10% on Wednesday morning after announcing a strategic alliance with Rebellions Inc – a South Korean artificial intelligence (AI) chipmaker. The new partnership aims at building custom AI infrastructure tailored to regional and sovereign-backed initiatives across Asia-Pacific and the Middle East.