NI Stock Recent News

NI LATEST HEADLINES

Dividends are one of the best benefits to being a shareholder, but finding a great dividend stock is no easy task. Does NiSource (NI) have what it takes?

NI is boosting growth through clean energy investments, strong regulated assets, rising dividends and solid earnings momentum.

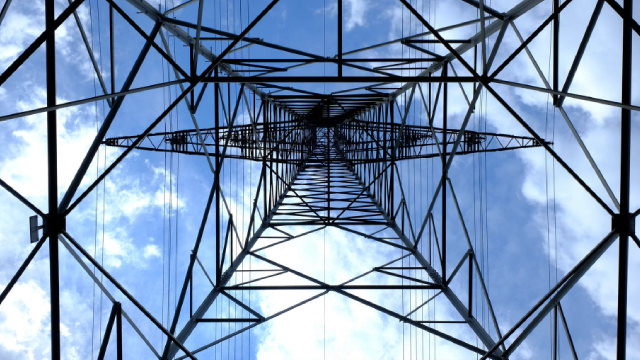

MERRILLVILLE, Ind.--(BUSINESS WIRE)--NiSource (NYSE: NI), one of the largest fully regulated utility companies in the United States, has published its 2024 sustainability report, emphasizing the company's dedication to operational excellence, safety, customer satisfaction and environmental stewardship. Titled Powering Vibrant and Viable Communities, the report details NiSource's advancements in sustainability, showcasing how the company has enhanced existing standards while leveraging technolog.

Dividends are one of the best benefits to being a shareholder, but finding a great dividend stock is no easy task. Does NiSource (NI) have what it takes?

MERRILLVILLE, Ind.--(BUSINESS WIRE)--The board of directors of NiSource Inc. (NYSE: NI) today declared a quarterly common stock dividend payment of $0.28 cents per share, payable November 20, 2025, to stockholders of record at the close of business on October 31, 2025.

NiSource Inc. (NYSE:NI ) Q2 2025 Earnings Conference Call August 6, 2025 11:00 AM ET Company Participants Durgesh Chopra - Corporate Participant Lloyd M. Yates - President, CEO & Director Melody Birmingham - Executive VP & Group President of NiSource Utilities Michael S.

Expected rise in production to meet demand, along with an increase in electricity prices, bodes well for the prospect of the Utility-Electric Power industry. Top-ranked utilities like CNP, FTS and NI are set to benefit from strong demand from their customer base.

NI's second-quarter earnings per share are better than expected. The company sells a higher volume of electricity in the reported quarter.

NiSource (NI) came out with quarterly earnings of $0.22 per share, beating the Zacks Consensus Estimate of $0.21 per share. This compares to earnings of $0.21 per share a year ago.

NiSource (NI -0.99%), a fully regulated utility serving gas and electric customers across the Midwest and Mid-Atlantic, released its second quarter 2025 earnings on August 6, 2025. The standout news was its adjusted non-GAAP earnings per share (EPS) of $0.22, which exceeded analyst estimates by $0.02 (non-GAAP) and showed growth from the prior year's $0.21 non-GAAP adjusted EPS.