SNA Stock Recent News

SNA LATEST HEADLINES

SNA's Q1 results reflect sales and earnings decline amid economic uncertainty, with segmental softness particularly in the Tools Group.

Shares of Snap-on (SNA) dropped sharply Thursday as its CEO attributed the toolmaker's weaker-than-expected results for the first quarter to "heightened macroeconomic uncertainty."

While the top- and bottom-line numbers for Snap-On (SNA) give a sense of how the business performed in the quarter ended March 2025, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

Snap-On (SNA) came out with quarterly earnings of $4.51 per share, missing the Zacks Consensus Estimate of $4.81 per share. This compares to earnings of $4.75 per share a year ago.

KENOSHA, Wis.--(BUSINESS WIRE)--Snap-on announced first quarter 2025 results. A call discussing the results will be webcast beginning at 10:00 am Eastern on www.snapon.com.

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

Get a deeper insight into the potential performance of Snap-On (SNA) for the quarter ended March 2025 by going beyond Wall Street's top -and-bottom-line estimates and examining the estimates for some of its key metrics.

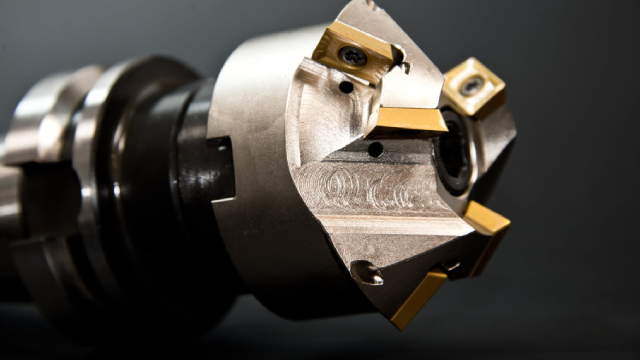

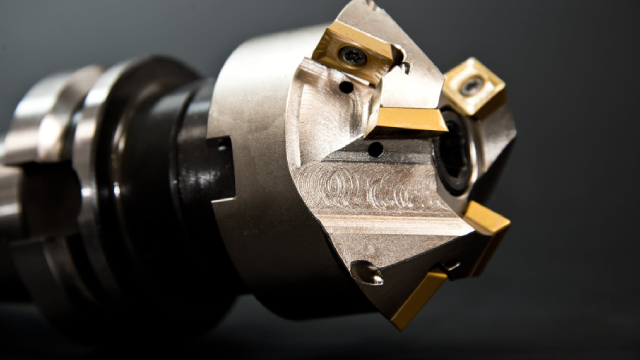

SNA's first-quarter results are likely to reflect the benefits of strong business trends, fueled by its value-driven strategy, ongoing innovation and strength in automotive repair.

KENOSHA, Wis.--(BUSINESS WIRE)--Snap-on will webcast its 2025 Annual Meeting of Shareholders live on Thursday, April 24 at 10:00 a.m. Central.

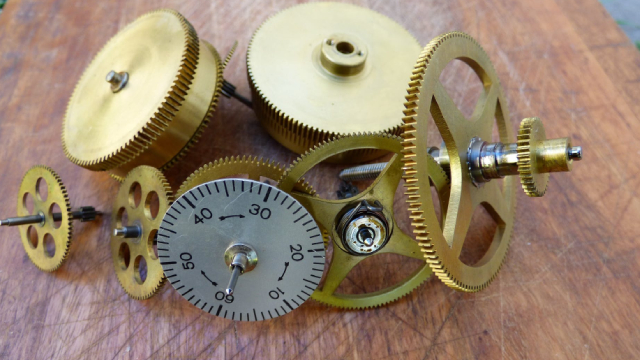

"We need to convince people that manufacturing is an American calling