SNA Stock Recent News

SNA LATEST HEADLINES

Dividends are one of the best benefits to being a shareholder, but finding a great dividend stock is no easy task. Does Snap-On (SNA) have what it takes?

Nick Pinchuk, Snap-on chairman and CEO, joins 'Squawk Box' to discuss the fallout from President Trump's global tariffs, how businesses are dealing with the sweeping new tariffs, and more.

KENOSHA, Wis.--(BUSINESS WIRE)--Snap-on will release first quarter results prior to the market open on Thursday, April 17, 2025, with a call discussing the results at 10:00am ET.

SNA's performance benefits from strategic initiatives such as enhancing the franchise network and expanding into critical industries in emerging markets.

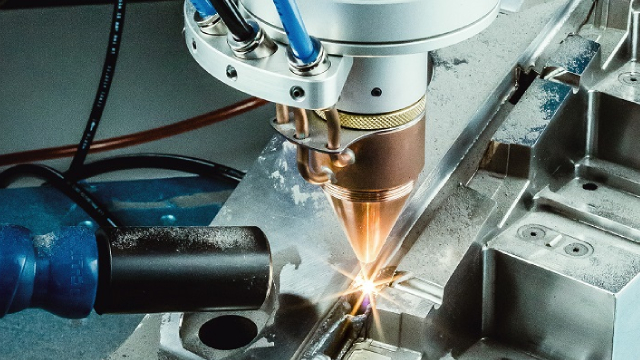

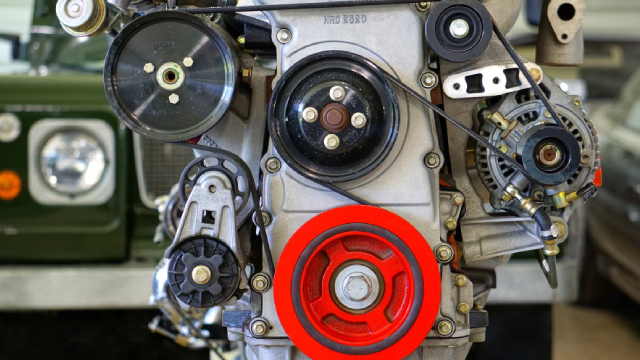

Snap-on Inc. has shown consistent growth with a 10.8% average annual net profit increase over the past decade. The company benefits from the aging car market and the growing complexity of EVs and hybrids, driving demand for advanced tools. Snap-on's capital expenditures have decreased as a percentage of net income, indicating efficient innovation without excessive costs.

Dividends are one of the best benefits to being a shareholder, but finding a great dividend stock is no easy task. Does Snap-On (SNA) have what it takes?

Snap-on's performance benefits from strategic initiatives such as enhancing the franchise network and expanding into critical industries in emerging markets.

KENOSHA, Wis.--(BUSINESS WIRE)--Snap-on is scheduled to present at two upcoming investor conferences, the Roth Conference and the Bank of America Global Industrials Conference.

Dividends are one of the best benefits to being a shareholder, but finding a great dividend stock is no easy task. Does Snap-On (SNA) have what it takes?

SNA's performance benefits from strategic initiatives such as enhancing the franchise network and expanding into critical industries in emerging markets.