SWK Stock Recent News

SWK LATEST HEADLINES

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

I analyze Barron's top 100 sustainable companies, focusing on dividend payers and using the dogcatcher yield-based strategy to identify value opportunities. Seven out of 83 dividend-paying sustainable stocks currently meet the ideal of annual dividends from a $1K investment exceeding their share price, signaling potential buys. Analyst targets project 20.21% to 45.71% net gains for the top ten ESG dividend stocks by August 2026, with average risk below the market.

High-yield dividend stocks are a popular option for investors looking for steady growth and consistent returns.

While the December 2024 interest rate cut of 25 basis points may be the last until September, it is an excellent bet that federal funds will be lower than today's effective federal funds rate of 4.33%, which is already below the long-term average of 4.61%.

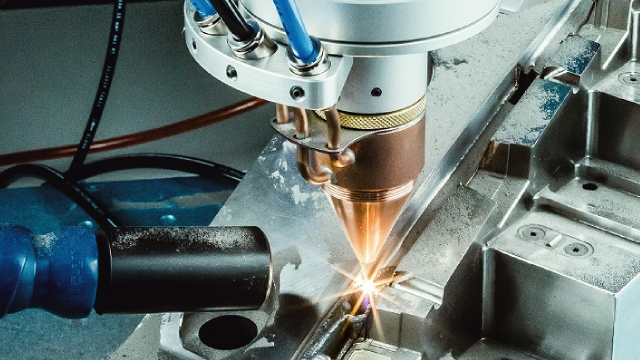

Stanley Black & Decker is undergoing a major transformation with significant cost cutting and asset sales, improving its bottom line despite revenue declines. The company's shares are attractively valued both on an absolute basis and relative to peers, supporting a soft 'Buy' rating. Ongoing risks include potential recession and tariff impacts, but management is proactively adjusting supply chain and pricing strategies.

Wondering how to pick strong, market-beating stocks for your investment portfolio? Look no further than the Zacks Style Scores.

Stanley Black & Decker is deeply undervalued, trading at 2011 levels despite strong brands and Dividend King status, offering a nearly 5% yield. Earnings are expected to rebound strongly after 2025, with current headwinds from tariffs and supply chain changes likely to ease. Lower interest rates and potential tariff relief could act as significant catalysts, making now an opportune time to buy low.

Companies ranging from Stanley Black & Decker to Conagra to Tesla have told analysts on earnings calls that higher tariffs will raise costs. The management remarks come as economists doubt that importers will continue absorbing cost increases tied to tariffs, and say they're likely to pass them on to consumers instead.

Despite decades of experience and renown as a toolmaker, Stanley Black & Decker (SWK -7.22%) couldn't fix investors' sentiment about its stock Tuesday. On the back of dispiriting second-quarter results published this morning, those folks sold out of the company's shares, leaving a more than 7% slide in price.