SWK Stock Recent News

SWK LATEST HEADLINES

NEW BRITAIN, Conn. , June 20, 2025 /PRNewswire/ -- Stanley Black & Decker (NYSE: SWK) will broadcast its second quarter 2025 earnings webcast on Tuesday, July 29, 2025.

Five of the ten lowest-priced S&P 500 Dividend Aristocrats are currently attractive buys, offering high yields and fair valuations for income investors. Analyst forecasts suggest potential net gains of 15.65% to 36.53% for the top ten Aristocrat Dogs by June 2026, with average risk below the market. Fifteen Aristocrats show negative free cash flow margins, signaling caution—dividends may not be sustainable for these cash-poor stocks.

SWK faces mounting pressure from falling segment sales, high costs and debt, dragging down earnings estimates.

More than three-quarters of today's younger DIYers surveyed feel confident they'll complete their planned projects in 2025 Top projects they want to complete include bathtub or shower replacements, interior painting and built-in storage and organization More than half of DIYers surveyed say a sense of accomplishment and pride pushes them to finish their projects TOWSON, Md. , June 5, 2025 /PRNewswire/ -- Despite a backdrop of uncertainty, younger homeowners don't plan to hit pause on their planned home improvement projects.

Most Dividend Kings are currently overpriced, but six offer fair value where annual dividends from $1,000 invested exceed their share price. Three top-yield Dividend Kings—Altria, Northwest Natural, and Canadian Utilities—meet the ideal 'dogcatcher' standard for fair pricing and dividend safety. Analyst projections suggest select Dividend Kings could deliver up to 58% total returns by June 2026, with lower volatility than the market overall.

Stanley Black & Decker (SWK) reported earnings 30 days ago. What's next for the stock?

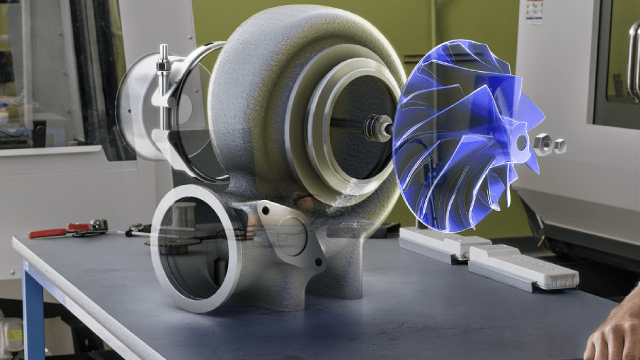

Cost of trade school is a key barrier for nearly half of pre-apprentices joining the trades, according to a recent DEWALT survey Scholarships will help fund trade education in fields including carpentry, welding and more TOWSON, Md. , May 28, 2025 /PRNewswire/ -- According to a recent survey from DEWALT, a Stanley Black & Decker (NYSE: SWK) brand and leader in total jobsite solutions, almost one-half of pre-apprentices are concerned with the cost of school.

I analyze Barron's top 100 sustainable companies, focusing on dividend-paying stocks using the yield-based 'dogcatcher' strategy for value and income. Six of 83 dividend-paying ESG stocks meet the ideal of annual dividends from $1,000 invested exceeding their share price, signaling potential value opportunities. Analyst targets suggest 20-45% net gains for the top ten ESG 'dogs' by May 2026, with risk and volatility varying by stock and sector.

Despite near-term tariff headwinds, I believe SWK's management has a clear mitigation plan, targeting full China exit and USMCA compliance by 2027. Cost savings, SG&A cuts, and product line disposals support stable margins and $500M+ free cash flow guidance for 2025, underpinning the 4.64% dividend yield. SWK's strong brand portfolio and scale position it to weather economic volatility and outperform peers, even amid construction and automotive sector softness.

Many S&P 500 Dividend Aristocrats remain overvalued, but select high-yield 'Dogs' like Realty Income and Amcor offer attractive entry points for income investors. Analyst forecasts suggest the top ten Aristocrat Dogs could deliver 16% to 38% net gains by May 2026, with average risk below the market. Caution: Fourteen Aristocrats have negative free cash flow margins, making their dividends less secure despite high yields—focus on 'safer' picks like Hormel.