SWK Stock Recent News

SWK LATEST HEADLINES

Stanley Black & Decker (SWK) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

Investors love dividend stocks because they provide dependable passive income streams and an excellent opportunity for solid total return.

Stanley Black & Decker (SWK) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely beat in its next quarterly report.

Barron's eighth annual (2025) ranking of sustainable companies started with the 1,000 largest publicly traded companies by market value, then ranked each by performance for five key constituencies: shareholders, employees, customers, community, and planet. Top-yielding sustainable stocks like Avient, Interpublic, and Campbell's offer attractive net gain potential, with average analyst-estimated returns of 26.26% for the top ten. Seventeen dividend payers show negative free cash flow margins, signaling caution; only three 'safer' stocks—Campbell's, Regions Financial, and Hormel—meet the ideal dividend-to-price ratio.

Maria Ford, President of U.S. Commercial & Industrial Sales, joins exclusive Council to share insights on matters impacting the construction industry and empowering the next generation of tradespeople TOWSON, Md. , July 14, 2025 /PRNewswire/ -- DEWALT, a Stanley Black & Decker (NYSE: SWK) brand and leader in total jobsite solutions, today announced Maria Ford, President of U.S. Commercial & Industrial Sales, has joined the Forbes Business Development Council, a prestigious community of senior-level sales and business development executives.

Shares of Stanley Black & Decker (SWK 3.45%) stock closed 3.4% higher on Tuesday after Wolfe Research analyst Nigel Coe removed his "underperform" (i.e., sell) rating from the stock, and upgraded shares of the toolmaker stock to peer perform (i.e.

U.S. equities were slightly lower at midday as the market weighed the potential impact of the latest Trump administration tariffs. The Dow Jones Industrials Average slipped 0.2%, and the S&P 500 and Nasdaq were down marginally.

Nearly three-quarters of residential pros surveyed say their clients are increasing the size of their 2025 projects Costs of materials and labor are cited as top concerns as pros plan for the year Many homeowners (93%) are embracing high-end design trends to upgrade their homes High job satisfaction and fulfillment in their work are reported by majority of residential pros TOWSON, Md. , July 8, 2025 /PRNewswire/ -- Despite the backdrop of the current economic and housing climate, many homeowners are still seeking to upgrade their homes by hiring residential contractors to complete their project plans in 2025.

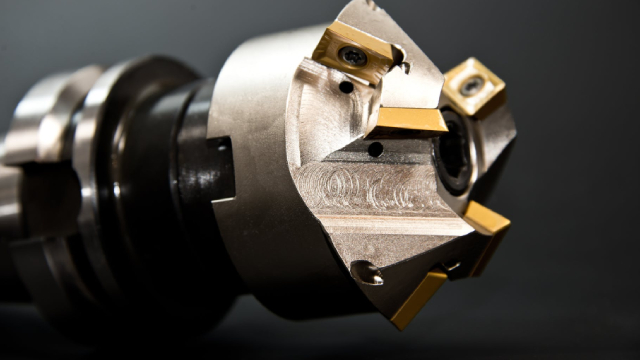

Persistent weakness in the manufacturing sector weighs on the Zacks Manufacturing-Tools & Related Products industry's near-term prospects. CNM, SWK and KMT are three stocks to retain.

Key Points in This Article: Dividend investing has offered reliable income and outperformance over non-payers for at least the last 50 years.