TSM Stock Recent News

TSM LATEST HEADLINES

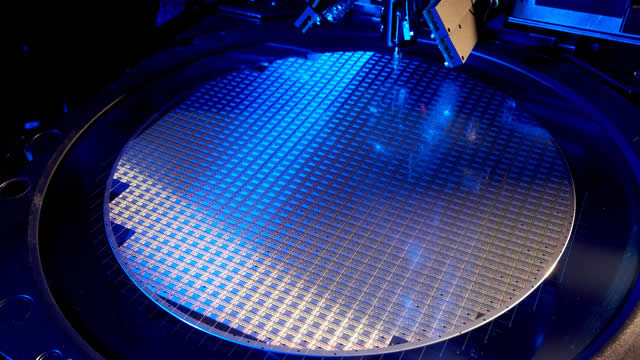

Last week, Taiwan Semiconductor Manufacturing Company Limited (NYSE: TSM), also known as TSMC, crossed an important psychological threshold for investors. The Taiwanese company surpassed a $1 trillion market capitalization, making it the first Asian company to do so since China's PetroChina oil and gas giant briefly achieved this milestone in 2007, notes GuruFocus.

Live Updates Live Coverage Has Ended More Details on NXP's Q2 4:52 pm by Eric Bleeker NXPI | NXP Semiconductors Q2’25 Earnings Highlights: Adj. EPS: $2.72 Revenue: $2.93B Adj. Gross Margin: 56.5%; DOWN -210 bps YoY Net Income: $690M; DOWN -17% YoY Q2’25 Outlook: Revenue: $3.05 billion to $3.25 billion Guidance reflects an emerging cyclical improvement in core end markets and company-specific growth drivers. Focus on solid profitability and earnings through portfolio strengthening and manufacturing strategy alignment. Q2 Segment Performance: Automotive Revenue: $1.73B ; FLAT YoY Industrial & IoT Revenue: $546M ; DOWN -11% YoY Mobile Revenue: $331M ; DOWN -4% YoY Comm. Infra. & Other Revenue: $320M ; DOWN -27% YoY Other Key Q2 Metrics: Adj. Operating Income: $935M; DOWN -13% YoY Adj. Operating Expenses: $505M ; DOWN -5% YoY R&D Expenses: $573M ; DOWN -4% YoY Free Cash Flow: $696M ; UP +21% YoY Effective Tax Rate: 18.3% (vs. N/A YoY) CEO Commentary: Kurt Sieve

TSM's long-term prospects remain bright, thanks to the ongoing AI boom and the insatiable appetite for high-tech 3nm/ 5nm chips, as exemplified by the raised FY2025 guidance. With the H20 export restriction to China already lifted, we are likely to see the foundry report excellent H1'26 financial numbers as well, once production is restarted. These reasons may also be why TSM and NVDA have charted new stock price peaks in recent days, albeit seemingly overbought by the time of writing.

Taiwan Semiconductor Manufacturing Company Limited's dominance in AI chip manufacturing has propelled a highly lucrative and successful partnership with Nvidia. High-performance computing now accounts for 60% of TSMC's revenue, indicating immense success in AI, but also raising revenue concentration risks. TSM stock's valuation has recovered spectacularly, but arguably in relatively expensive zones once more.

Buying and holding a single stock is a terrible investment strategy. Don't do it.

Artificial intelligence (AI) investing is still a dominant theme in the market. A substantial amount of money is being invested in building out AI production capabilities, and a select group of stocks is benefiting from this spending.

Shares of Taiwan Semiconductor Manufacturing (TSM -0.65%) jumped after the semiconductor contract manufacturer reported strong Q2 results and issued an upbeat outlook. The stock is now up nearly 25% on the year.

Wendell Huang, senior vice president and CFO of TSMC, says the company views currency volatility as a big uncertainty to its margins and is constantly reviewing hedging strategies to manage the impact on business. He speaks exclusively with Annabelle Droulers on Bloomberg Television.

The latest stellar earnings report lifted shares of chip maker Taiwan Semiconductor Manufacturing to a new high.

Zacks.com users have recently been watching TSMC (TSM) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.