TSM Stock Recent News

TSM LATEST HEADLINES

TSM's blowout Q2 performance fuels gains for ETFs like SPWO, SPTE, SMH, MEMX, and EMM, all heavily exposed to the AI chip leader.

TSMC dominates AI chip manufacturing with over 90% market share, leveraging advanced technology and strong customer relationships with Nvidia, Apple, and AMD. Stellar Q2 results highlight robust AI demand, with revenue up 44.4% YoY and management raising full-year growth guidance to 30%. The company's proven ability to consistently generate strong profits demonstrates its economies of scale, cost efficiency, and pricing power due to its leadership position in chip manufacturing.

Taiwan Semiconductor Manufacturing Company Limited delivered strong Q2 results, beating earnings estimates and showcasing robust revenue growth driven by soaring AI chip demand. Margin expansion highlights TSMC's ability to translate top line growth into higher profitability, reinforcing its leadership in the chip manufacturing sector. TSMC remained widely free cash flow profitable in Q2'25 and the outlook implies strong tailwinds for FCF and earnings growth.

TSMC Chief Financial Officer Wendell Huang speaks to Bloomberg's Annabelle Droulers about the business outlook, the impact of tariffs, FX volatility and more. -------- Like this video?

TSM tops Q2 forecasts with 61% EPS growth, driven by strong demand for advanced chip nodes.

Taiwan Semiconductor's soaring AI revenues, aggressive investments and lower valuation give it an edge over NVIDIA as the better AI stock bet.

Alert confirms a reversal in early weakness in TSM

The bull market that started in October 2022 has been dominated by a single theme: artificial intelligence (AI). Over the past three years AI has dominated the conversation on Wall Street regarding how it holds the potential to transform businesses, create new opportunities, and drive earnings growth for numerous industries.

Prediction: Taiwan Semiconductor Manufacturing Will Soar Over the Next 5 Years. Here's 1 Reason Why.

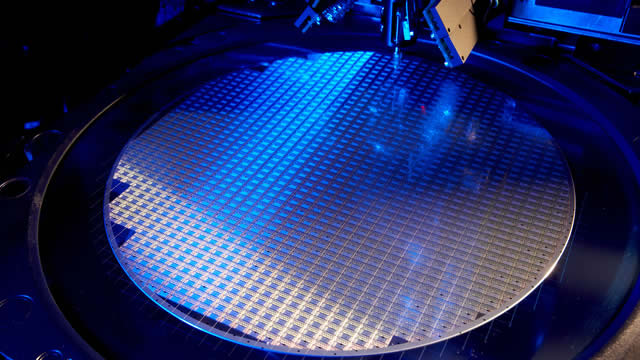

Chipmaking giant Taiwan Semiconductor Manufacturing (TSM 3.38%) -- also known as TSMC -- doesn't get the attention that other big tech companies tend to get, but it's an under-the-radar dynamo that powers much of the world's technology. Companies come to TSMC with chip designs; TSMC brings those designs to life.

While the conventional view of investing suggests that there are two core styles of investing -- growth and value -- I believe this notion is flawed. In reality, there's just value investing.