TXN Stock Recent News

TXN LATEST HEADLINES

Zacks.com users have recently been watching Texas Instruments (TXN) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

Texas Instruments Incorporated (NASDAQ:TXN ) Goldman Sachs Communacopia + Technology Conference 2025 September 10, 2025 1:50 PM EDT Company Participants Haviv Ilan - CEO, President & Director Conference Call Participants James Schneider - Goldman Sachs Group, Inc., Research Division Presentation James Schneider Senior Research Analyst Okay. Good morning, everybody.

Texas Instruments (TXN) closed at $185.84 in the latest trading session, marking a -1.11% move from the prior day.

Semiconductor stock Texas Instruments Inc (NASDAQ:TXN) was last seen down 3.9% at $188.09 as it heads for its sixth-straight daily drop.

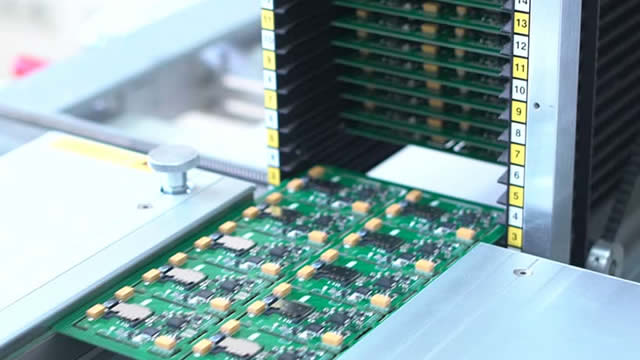

Texas Instruments is building a $60 billion U.S. manufacturing megaproject where Apple vows to make “critical foundation semiconductors” for iPhones and other devices. CNBC's Katie Tarasov went to Sherman, Texas, for an exclusive first look inside TI's newest fab that is part of a seven-building project across Utah and Texas to provide U.S.-made chips to customers like Nvidia and Ford.

Texas Instruments Incorporated (NASDAQ:TXN ) Citi's 2025 Global Technology, Media and Telecommunications Conference September 4, 2025 8:10 AM EDT Company Participants Rafael Lizardi - Senior VP & CFO Mike Beckman - VP & Head of Investor Relations Conference Call Participants Christopher Danely - Citigroup Inc., Research Division Presentation Christopher Danely MD & Analyst Thanks, everyone. I'm still Chris Danely, your friendly neighborhood semiconductor analyst here at Citi.

U.S. chipmaker Texas Instruments said on Thursday demand cooled after a spike in April as customers ordered ahead of President Donald Trump's so-called "Liberation Day" tariffs, sending its shares down 5%.

Jim Cramer breaks down why he's keeping an eye on shares of Texas Instruments.

Texas Instruments' 8.9% stock surge is fueled by AI, data centers and CHIPS Act aid, but trade and auto risks keep outlook cautious.

TXN is a Buy for risk-tolerant, dollar-cost averaging investors, with deep undervaluation and long-term upside driven by U.S. manufacturing and AI exposure. Strategic U.S. footprint, favorable tax law changes, and AI/data center tailwinds set up a potential surge in free cash flow and intrinsic value above $350. Near-term risks include decelerating revenue guidance, margin pressure from heavy CapEx, and an unsustainable dividend payout from depressed FCF.