UNH Stock Recent News

UNH LATEST HEADLINES

The Dow Jones Industrial Average (^DJI 1.31%) rose 3.2% in August 2025, comfortably ahead of the broader S&P 500 (^GSPC 0.81%) index, which gained 1.9% in the same period. But the Dow's impressive performance was built on a mixed bag of specific stock performances.

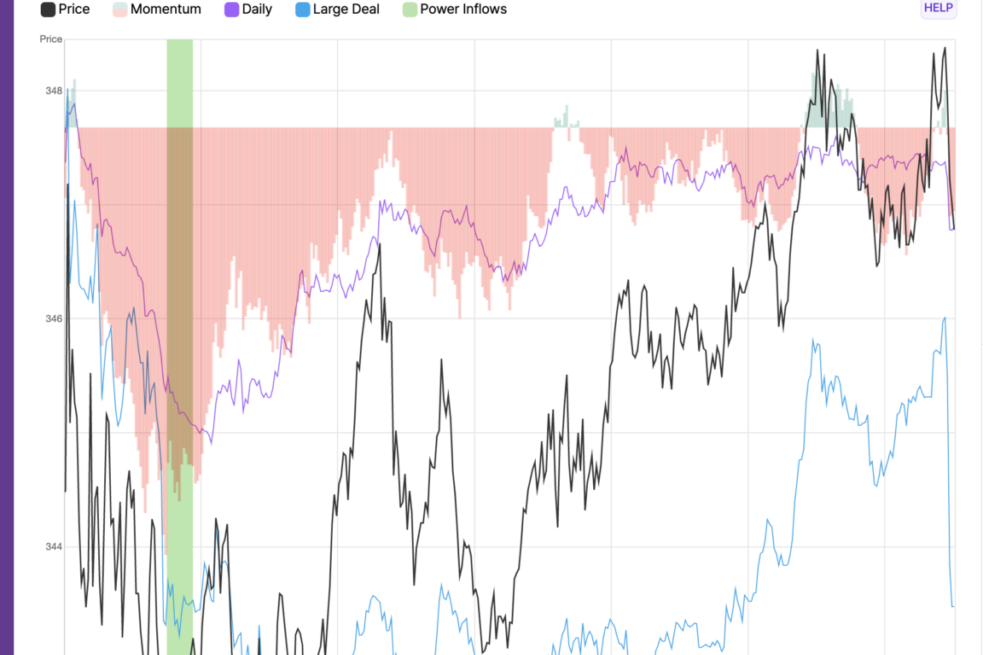

UNH moves up over 5 points after the alert

Dividend income can be extremely valuable for long-term investors as it can help pad your overall returns from a stock. Simply chasing high-yielding stocks, however, isn't necessarily the best or safest idea, as those payouts aren't always sustainable.

I remain bullish on UNH for long-term investors, despite current margin pressures and regulatory risks, due to its strong fundamentals and revenue growth. The transition to a Value-Based Care (VBC) model is a key strategic shift that will take time but promises significant profitability improvements once mature. Short-term risks include negative margins in early VBC cohorts, regulatory hurdles, and challenges in accurately estimating medical costs, but these are manageable.

The Investment Committee debate the latest Calls of the Day.

UNH surges 8.6% as it projects stable Medicare Advantage star ratings, easing investor worries over performance.

Trying to time the market with falling knives like UnitedHealth—which it was in the spring and summer—was extremely risky, so I chose to wait for momentum to return. Valuation metrics are attractive, with forward P/E and P/S ratios far below historical averages, making UNH a compelling value due to rock-solid fundamentals. Yesterday's reiteration of the EPS outlook by the management is crucial, as it underscores that the headwinds are temporary and their adverse effects are unlikely to persist for long.

Many retail investors fear selloffs. But if you know where to look, pullbacks can be your best friend. If you look at any stock that pulled off a significant recovery from its trough, your natural reaction is likely “I wish I bought that dip!” However, it’s understandable why many refuse to buy the dip. Many stocks that do go down turn into falling knives. When it comes to well-established dividend payers, the equation is in your favor. Instead of praying for a recovery, you get paid to wait, and that stream of dividends quietly compounds while the market decides whether it still wants to sit on the sidelines. Chances are, the market will decide to pounce, especially since the economy is sitting at a crossroads. Interest rates are expected to be cut soon, making dividend yields more attractive. Plus, undervalued dividend stocks with established underlying businesses are very likely to rebound in the long run. This gives investors both upside and dividends. Here are th

UnitedHealth Group (NYSE: UNH) jumped 8% on September 9, 2025, after the company said it is on track to meet its Medicare Advantage enrollment goals. The update eased investor concerns that the insurer could miss these critical targets amid ongoing operational challenges.

David Tepper's bold second-quarter buying spree in UnitedHealth Group Inc. UNH is already paying off. The billionaire hedge fund manager's Appaloosa Management increased its stake in the health insurance giant by a staggering 1,300% last quarter, turning a once-minor position into his fund's second-largest holding.